Udemy Earns More, Pays Instructors Less: Class Central Exclusive

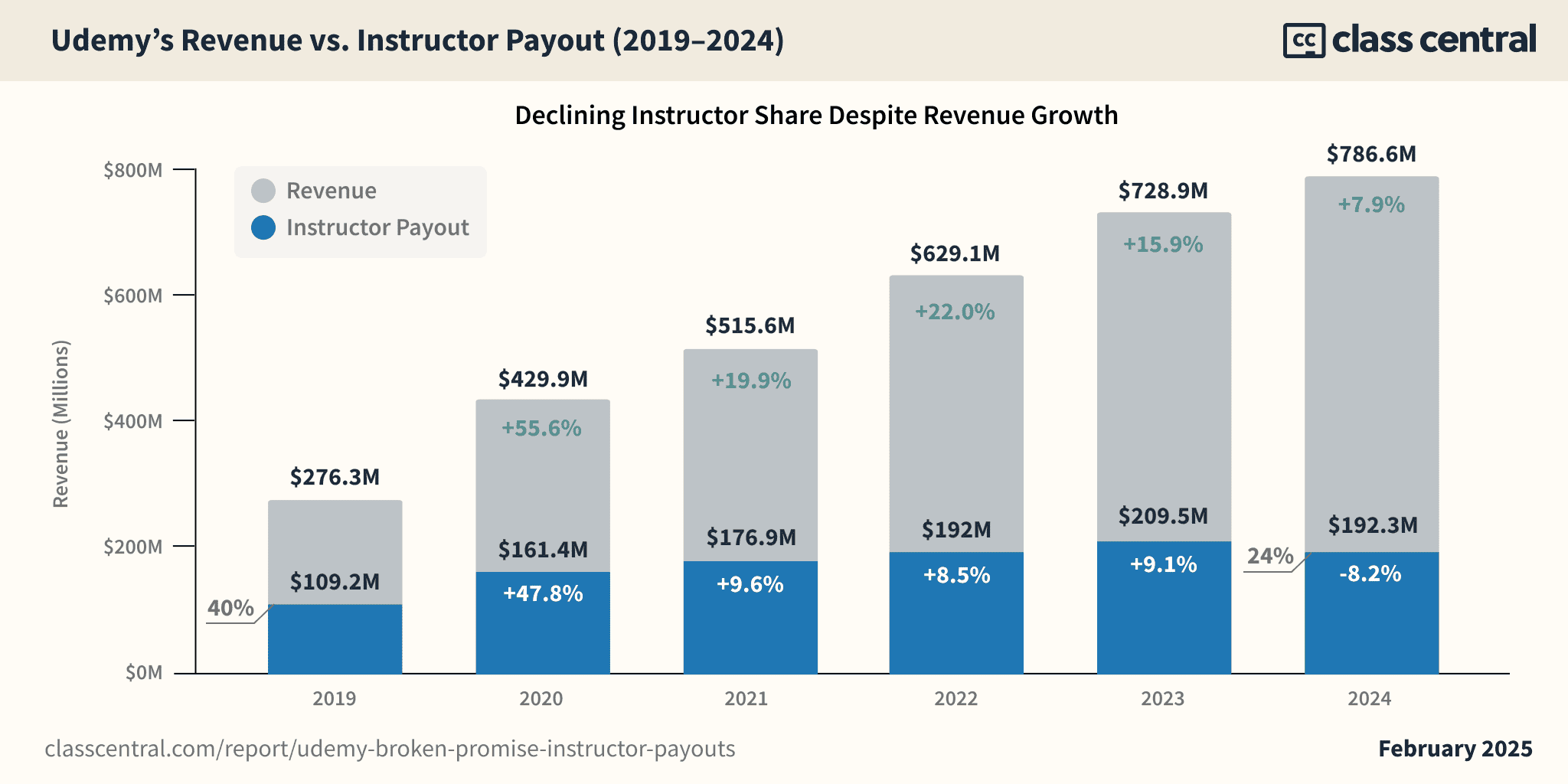

Despite assurances of sustained instructor earnings, Udemy’s policy changes delivered a $30 million pay cut, sacrificing creator income to bolster its stock value.

How did Udemy manage to increase its gross profit by 17% to $491.9 million in 2024, despite revenue growth of only 8% to $786.6 million? The answer: by paying instructors less—$30 million less, if my calculations are correct.

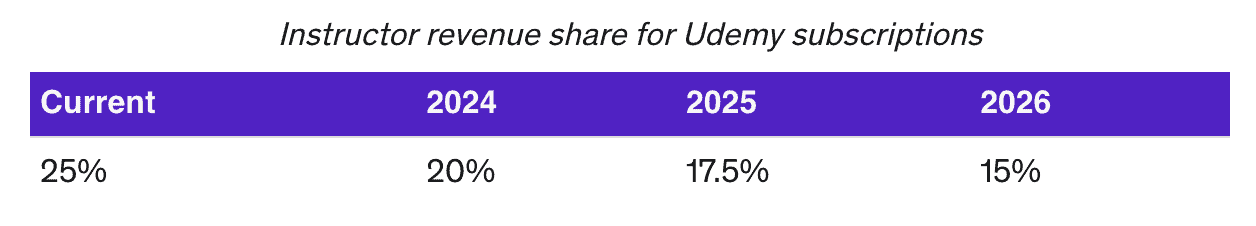

Udemy announced its new instructor revenue share model in November 2023, claiming “this change is calibrated against our expected growth rate, with the goal that total instructor payouts will equal or exceed their current levels each year.”

The day this was announced, Udemy’s stock price jumped by $800M.

This claim seemed dubious even in 2023, with at least one investor questioning it during the earnings call. For Udemy’s claim to hold true, at bare minimum, the company would have needed to grow Udemy Business (UB) by 25% (instead of the actual 17% growth in 2024).

Udemy’s Revenue Sharing Model (2023)

Udemy operates two primary business segments: Consumer and Enterprise. The Enterprise segment is purely subscription-based, with companies purchasing annual licenses for employees. The Consumer segment, however, operates on two distinct models.

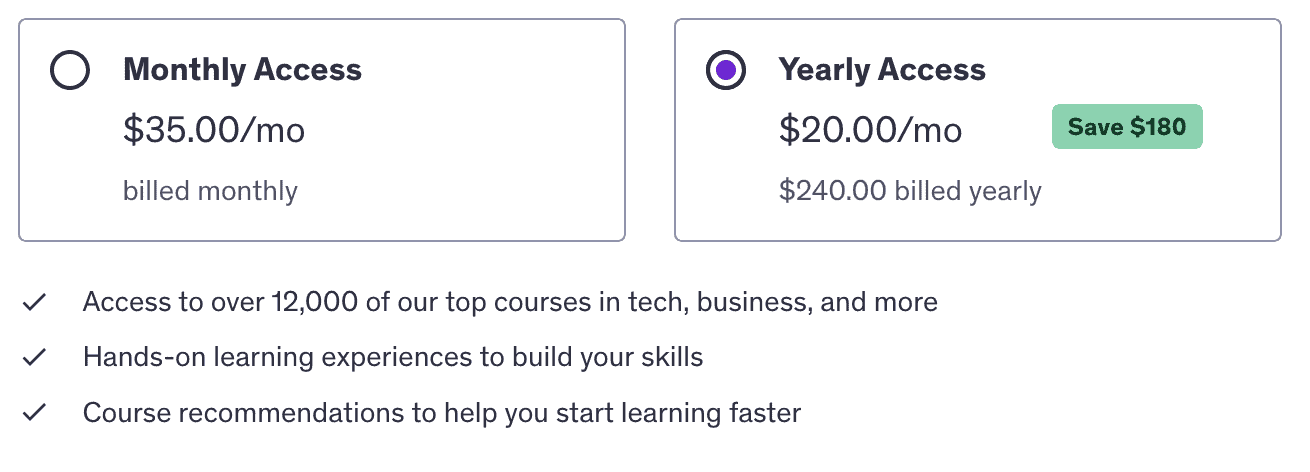

Learners can either buy individual courses from Udemy’s marketplace, or subscribe to a “Personal Plan” at $35 monthly/$240 annually for access to 12,000+ courses.

| Instructor Revenue Share | |

| Marketplace | 37% |

| Subscription | 23% (but claims 25%) |

But here’s the catch – diving into Udemy’s 2023 10-K, I discovered that the actual “content costs” (corporate speak for instructor payments) for Enterprise was 23%, not 25%. I’ll use this 23% figure as the baseline for my calculations below.

The Shrinking Instructor’s Share (2024 – 2026)

So, what exactly was this change? In a November 2023 announcement, Udemy explained that to “enable key investments and business growth,” they were adjusting the instructor revenue share for their subscription model.

Effective January 2024, the share dropped from 25% to 20%. But that’s just the beginning – Udemy plans to reduce it further to 17.5% in January 2025, and then to 15% in January 2026.

While the marketplace revenue share (37%) remains unchanged, the subscription model is the primary focus. Udemy Consumer has been declining since its peak in 2021, and within that segment, non-subscription revenue (i.e., single course purchases) is also shrinking.

Subscription-based offerings, including Udemy Business and personal plan subscriptions, account for 65% of Udemy’s revenue.

Essentially, they’re taking a bigger cut of the pie, claiming it’s to fund their growth, while promising instructor payouts will somehow still increase. Based on 2024’s numbers, that promise looks demonstrably false.

This is not the first time Udemy has cut instructor revenue share (and probably not the last time). In 2019, Udemy decreased instructor revenue share from 50% to the current 25%.

The Impact: A $30 Million Cut

Let’s run the numbers to see exactly how much instructors lost due to this policy change. Using content cost percentages from Udemy’s 2023 10-K (23% for Enterprise, 37% for Consumer), we can estimate instructor payouts with and without the November 2023 policy change.

| Instructor Payouts | 2024 (New Policy) | 2024 (Old) | 2023 | 2022 |

| Enterprise | 89M | 113.8M | 95.8M | 73.7M |

| Consumer | 102.2M | 108.1M | 113.7M | 118.8M |

| Total | 191.2M | 221.9M | 209.5M | 192.5M |

The difference is significant: Under the old policy, instructors would have earned $221.9 million in 2024. Instead, they’re now on track to earn $191.2 million – a $30.7 million cut. This pushes total instructor payouts back to 2022 levels, effectively erasing two years of growth.

In 2024, Udemy’s massive catalog expanded by 54,000 new courses, with thousands of new instructors joining the platform. This growth further dilutes the average revenue per instructor.

Further analysis is needed to understand how instructors are responding to this change. However, it’s likely that this policy incentivizes instructors to prioritize quantity over quality, as they compete for a limited pool of revenue. With the average revenue per course already below $100, high-quality instructors may find it unsustainable to invest weeks or months in creating new courses.

The situation is going to get a lot worse. With Udemy projecting only 1% growth for 2025 and two more revenue share reductions planned (to 17.5% in 2025 and 15% in 2026), instructor earnings are poised to decline even further.

Tags