Scaler Academy’s Big Lie: How India’s EdTech Darling Inflated Revenue by 15x

Scaler Academy projected $200M in revenue but delivered only a fraction. Class Central’s exclusive analysis reveals another major EdTech deception in India

I recently uncovered a major factual inaccuracy in a statement by an Indian EdTech company. It reminds me of Lambda School/Bloomtech—not just because they’re both coding bootcamps, but also due to their questionable claims and practices.

In 2022, Scaler Academy, rather, one of its founders, Abhimanyu Saxena, claimed:

Scaler, one of India’s fastest-growing tech upskilling startups, announced cumulative revenue growth of 2500% between FY 2020 and 2021, reaching an Annual Revenue Rate (ARR) of $110 million by August 2022. Due to its capital-efficient model, Scaler achieved year-over-year growth above 350% and maintained a monthly revenue growth rate of 15%.

TC; DU (Too Complicated; Didn’t Understand) version: Scaler claimed to be profitable and estimated its ARR (a method of projecting revenue over a longer period, usually one year, based on previously earned revenue) at around $110 million.

Everyone started talking about it, including YourStory and MoneyControl. Scaler’s CEO also told MoneyControl they expect to reach $200 million ARR by March 2023.

It’s now 2025, and I decided to fact-check their claims, only to find that these numbers aren’t aspirational; they’re just digits in the air.

Hype vs. Reality: The Actual Numbers

First, let’s examine their revenue and losses. I have converted these figures from Indian rupees into millions of dollars.

After the ‘$200 million ARR’ announcement, Scaler’s combined revenue for the next three years (FY 2022, FY 2023, FY 2024) was approximately $90 million, and they lost $75 million along the way.

Not only did they fall drastically short of the $110 million ARR dream, but Saxena also leaped to an even more ambitious $200 million claim. The gap between forecast and reality is staggering.

And remember, all this was supposedly going to happen while being profitable.

So, where did these numbers come from?

If the FY 2022 revenue was $7.5 million, how could ARR reach $200 million in 2023? Especially if it was nowhere near the $110 million the founders previously expected?

Annual Revenue Run Rate is a forecast based on past revenue, market conditions, potential expansions, and more. Were these factors even considered in their calculations? Or was this simply overconfidence fueled by their fresh Series B funding of $55 million from Lightrock India?

Here’s what John Curtius, Partner at Tiger Global (another Scaler investor), said:

As an experienced investor in India’s startup ecosystem, we are particularly bullish about the country’s edtech companies. Scaler’s relatively young age is more than made up for by the vision and maturity of its founders and the 800-plus-member team that is on a mission to disrupt India’s tech education space.

Scaler Academy’s Efforts to Increase Revenue

Mind you, Scaler tried to push their sales. They claimed that their losses in 2023 were due to extensive marketing investments as they expanded their courses.

Even their salespeople have been following up with people who’ve attended free workshops and masterclasses. A Reddit user complained about the incessant calls. They even tried to convince him to leave his job (which he was satisfied with) to take their course and earn more.

There was also news of layoffs in 2024, where 10% (150 employees) of the workforce were fired. While this seemed like a loss-reduction move, Scaler had made another revenue-generating move: acquiring Pepcoding in May 2023. Their fourth acquisition in two years.

Saxena claimed that acquisitions have helped them “strengthen their current offering and allowed us to enter newer verticals”, but acquisitions are also known to land a new customer base.

Despite these measures, the revenue didn’t escalate much, especially from 2023 to 2024, because the revenue only increased by $8 million in 2024.

So the big question still remains: What made them estimate an ARR that’s 15-20 times their revenue?

When the founder made this statement, India’s edtech industry was already facing a downfall in investments.

Unacademy was valued at $3.44 billion in 2021, Byju’s was valued at $16.5 billion in 2021, and Vedantu was valued at $1 billion in 2021.

In 2022, the tables started turning.

Unacademy started cutting costs in 2022 and prioritizing profitability. In 2024, it was also reported that Allen Career Institute was acquiring the previously valued $3 billion startup for $800 million.

Byju’s downfall had begun too. The company had reported a loss of $617 million in 2021 and had delayed filing its 2021/2022 financial results by nearly a year.

While major edtech companies were struggling, why didn’t Scaler factor in the industry’s decline when making revenue projections?

And, it’s not just Scaler. Other edtech companies, too, have been called out for misrepresenting numbers.

The Age of Inflating Numbers

This isn’t the first time Class Central has caught an edtech company inflating its numbers.

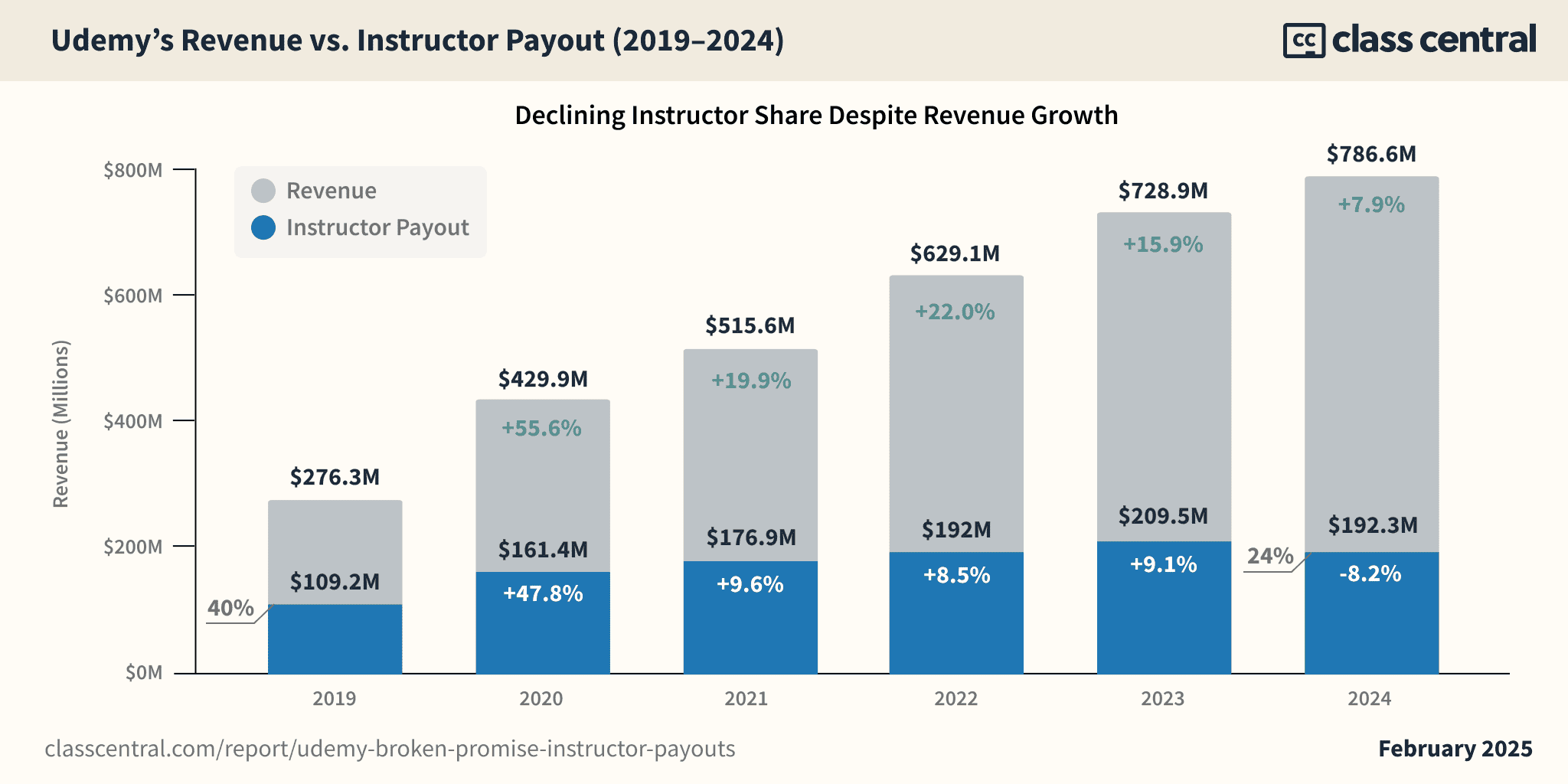

Udemy announced its new instructor revenue share model in November 2023, claiming, “This change is calibrated against our expected growth rate, with the goal that total instructor payouts will equal or exceed their current levels each year.”

The day this was announced, Udemy’s stock jumped, increasing its market value by $800 million. This claim seemed dubious even in 2023. Class Central analysis shows that total Udemy instructor payouts were $209.5 million in 2023, dropping to $192.3 million subsequently.

Recently, TechCrunch published a piece on how 11x portrayed their Annual Recurring Revenue by calculating clients enrolled for trial periods (even when most qualify for free trials) and long-term services. This increased their credibility because clients like Airtable (who tested their services and didn’t sign a contract) were featured on their website.

Even after such companies ended their trials, the company continued to count ARR as if they were on a long-term contract. For example, according to an employee, the company would claim $14 million in ARR even when the contracts that were signed after the three-month trial period were about $3 million.

Scaler Academy and 11x take me back to the Lambda School/Bloomtech controversy, which Class Central covered last year. Lambda School rose as a massive innovator in the coding education space and as an Income-Sharing Agreements platform. But, its model ultimately drew heavy criticism for deceptive practices concerning both job placement rates and the structure of its ISAs.

The Effect of Misrepresentation

In a survey, 169 CFOs were asked why they lie on earnings reports, and two reasons fit Scaler Academy’s bulked-up figures.

Companies lie because:

- Senior managers are overoptimistic or overconfident

- They believe misrepresentation may go undetected

In Scaler’s case, the founder said it in an interview or a press release, not in a report or an audited document. So who cares about being careful or accurate?

Has anyone rectified the numbers based on recent revenues? Bear in mind, they had the opportunity to do that, since the article that had the statement was updated in February 2024.

This makes us wonder: How can we trust founders who toss numbers in the air without calculating? And even if they do, will they turn back and give us accurate information?

The numbers affect anyone who reads them, believes them, and acts on them. Maybe that’s the point. This is the pervasive fake-it-till-you-make-it mindset, which venture capitalists even reward.

For instance, in 2022, a 24-year-old engineer was offered 4X of his salary to join a “soonicorn” startup that was valued from $500 million to $900 million and had received $100 million in funding. When his dad suggested joining a “safer” company, he stood his ground. Eight months later, he was laid off.

When companies like Scaler share inflated numbers in the media, and are backed by massive funding, even their investors share the onus of promoting realistic growth. Scaler raised $76.5 million from prominent investors—Lightrock India, Sequoia Capital India (now Peak XV Partners), and Tiger Global Management—at a valuation of $700 million.

It’s also worth asking: where were these investors when such blatant misinformation was being spread?

Rez

Man you should check German Ed-tech companies, I learned and WAS TEACHING there. they got money from the federal “Job center” claiming +90% placement rate. in reality 20-40% got jobs and they have bad reputation for accepting anyone and putting bad students not only in job market but also above teachers. I have a lot to say about it