6 Best Investment Courses for 2025: Invest Smart, Amass Wealth

From financial analyst training to bonds, stocks, real estate, and options, learn from renowned experts.

Explore the world of investment with our curated guide. Whether you’re just starting to navigate the intricacies of financial analysis, bonds, stocks, real estate, or options, or if you’re looking to understand the impact of ESG factors on your investments, our Best Courses Guide (BCG) has handpicked courses to suit your needs. From over 400 investment courses in our catalog, we’ve chosen the best options for you, covering everything from market trends to pragmatic investment strategies. Find the perfect course to level-up your financial understanding and decision-making skills.

Click on the shortcuts for more details:

Here are our top picks

| Course Highlight | Workload |

| Best Financial Analyst Training & Investing Course (Udemy) | 23 hours |

| Best Bonds & Fixed Income Securities Course (Udemy) | 4-5 hours |

| Best Investing in Stocks Course (Udemy) | 17 hours |

| Best ESG Investment Course (University of Pennsylvania) | 8 hours |

| Best Real Estate Financial Modeling Course (Udemy) | 9 hours |

| Best Options Trading Course for Beginners (projectfinance) | 3 hours |

Special Finds

Courses Overview

- 2 courses are free or free-to-audit and 4 are paid.

- The most featured provider is Udemy with 4 courses.

- All courses combined have over 600K enrollments and 17M YouTube views.

Best Financial Analyst Training & Investing Course (Udemy)

If you aspire to become an expert investor or kickstart a career as a financial analyst, The Complete Financial Analyst Training & Investing Course is the ideal learning path for you. This comprehensive and hands-on program is taught by Chris Haroun, an award-winning MBA professor with experience at Goldman Sachs, hedge funds, and venture capital, this course equips participants with essential skills and tools used in the finance industry.

In this course, you will:

- Master Key Finance Skills:

- Learn how to pick stocks and manage portfolios

- Become an Excel pro for financial analysis

- Value Companies Like a Pro:

- Understand different ways to figure out a company’s worth (valuation)

- Create target prices using practical methods

- Build Financial Models Easily:

- Make financial statements and predict the future using simple models

- Get hands-on with Excel templates for real-world situations

- Know Your Finance Career Options:

- Explore 14 different finance jobs like investment banking or venture capital

- Understand the good and not-so-good parts of each job

- Use What You Learn in Real Life:

- Apply your skills to actual work with templates and practical exercises

- Practice pitching ideas and finding good investments

- Find Your Passion in Finance:

- Learn about different finance jobs to discover what excites you

- Get guidance on choosing a career that matches your interests.

| Course | The Complete Financial Analyst Training & Investing Course |

| Provider | Udemy |

| Instructor | Chris Haroun |

| Time Commitment | 23 hours |

| Enrollment | 267K |

| Rating | 4.7 (32K) |

| Hands-on Exercises | Yes |

| Certificate | Available, paid |

Best Bonds & Fixed Income Securities Course (Udemy)

For those looking to gain foundational knowledge in bonds and fixed income securities, the Bonds & Fixed Income Securities: Structure, Prices & Markets is an excellent starting point. Taught by Paul Siegel, an experienced capital markets industry practitioner, this beginner-level course dives into the characteristics, valuation, and analysis of fixed income securities, covering various sectors and products within the fixed income markets.

In this course, you will:

- Understand the structure and mechanics of primary and secondary markets for fixed income securities

- Differentiate between bonds and loans, and explore valuation issues for each

- Explore contract features of bonds, including day count conventions, risk, returns, and yield calculation

- Learn about pricing and yield curves for fixed income instruments

- Examine structured securities such as MBS, ABS, and CDOs

- Understand the issuance and trading of different types of fixed income securities

- Analyze the impact of interest rates on fixed income securities pricing

- Discuss the role of market makers and intermediaries in the trading process.

| Course | Bonds & Fixed Income Securities: Structure, Prices & Markets |

| Provider | Udemy |

| Instructor | Paul Siegel and Starweaver Instructor Team |

| Time Commitment | 4-5 hours |

| Enrollment | 11K |

| Rating | 4.5 (2K) |

| Certificate | Available, paid |

Best Investing in Stocks Course (Udemy)

Whether you are a beginner or looking to enhance your investing strategies, Investing In Stocks The Complete Course! (17+ Hours) provides a step-by-step guide and real-life examples to help you pick stocks, analyze companies, and manage your portfolio effectively. Taught by Steve Ballinger, a successful long-term investor with an MBA, this course offers valuable insights and techniques.

In this course, you will:

- Gain a complete understanding and confidence in investing in the stock market

- Apply best practices and techniques to make informed stock choices

- Utilize basic and advanced stock screeners to narrow down your options

- Perform qualitative research and analyze quantitative ratios without complex calculations

- Implement key stock investing strategies, including dividend-paying stocks, growth stocks, value stocks, and more

- Evaluate different service providers, such as online discount brokers, full-service brokers, and robo-financial planners, to place stock orders

- Place actual orders, including market orders, stop-loss orders, and limit orders

- Assess risk and volatility of stocks, mutual funds, and ETFs using established metrics like Standard Deviation and Beta

- Select individual stocks, stock mutual funds, and exchange-traded funds for your investment portfolio.

| Course | Investing In Stocks The Complete Course! (17+ Hours) |

| Provider | Udemy |

| Instructor | Steve Ballinger |

| Time Commitment | 17 hours |

| Enrollment | 253K |

| Rating | 4.6 (43K) |

| Quizzes/Assessment Items | Yes |

| Certificate | Available, paid |

Best ESG Investment Course (University of Pennsylvania)

Beyond ethical considerations, companies with robust ESG (Environmental, Social, and Governance) practices are better positioned for long-term success, demonstrating resilience against risks, fostering positive stakeholder relations, and improved financial performance.

Embark on an exploration of ESG factors and their impact on financial value with the course ESG Risks and Opportunities from the University of Pennsylvania. Taught by Witold Henisz, a renowned professor of management at the Wharton School, this free-to-audit course equips you with the knowledge and best practices for integrating ESG considerations into your investment decisions.

In this course, you will:

- Understand how ESG factors influence financial value through various pathways

- Explore the history and evolution of ESG investing, examining different strategies employed by investors over time

- Learn the significance of ESG data and how to effectively incorporate it into financial analyses

- Examine the specific cost and revenue variances associated with ESG issues and discover how improved stakeholder relations can mitigate risks

| Course | ESG Risks and Opportunities |

| Provider | Coursera |

| Institution | University of Pennsylvania |

| Instructor | Witold Henisz |

| Time Commitment | 8 hours |

| Enrollment | 27K |

| Rating | 4.6 (714) |

| Quizzes/Assessment Items | Yes |

| Certificate | Available, paid |

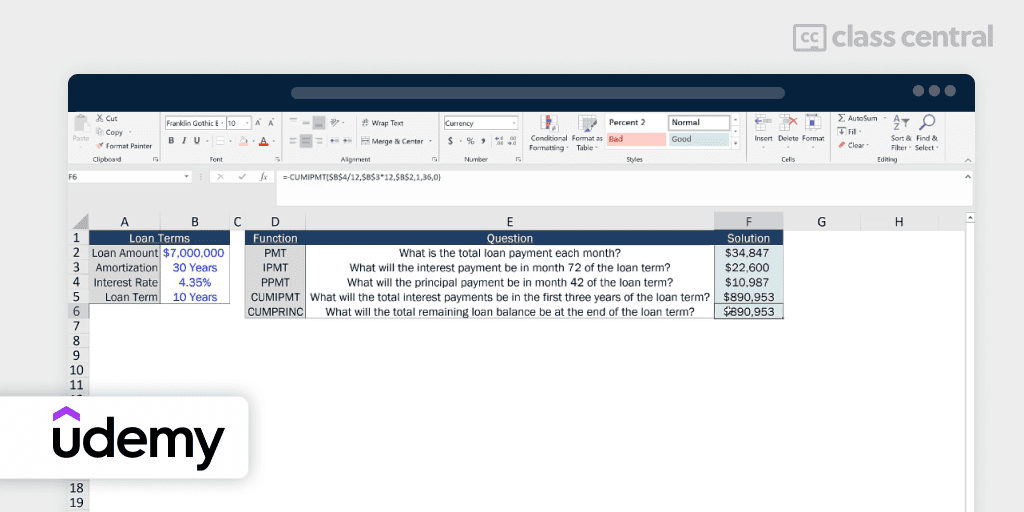

Best Real Estate Financial Modeling Course (Udemy)

If you aim to get into the real estate private equity industry, enhance your compensation at your current real estate job, or confidently analyze and model commercial real estate investments on your own, this course is for you.

The Real Estate Financial Modeling Bootcamp covers everything you need to know about modeling real estate transactions in Microsoft Excel for smarter real estate investing. Taught by Justin Kivel, an experienced real estate private equity professional with a track record of modeling over 1.5 billion dollars of closed commercial real estate transactions, this course equips you with the skills and knowledge to excel in the real estate industry.

In this course, you will:

- Build functional, dynamic real estate financial models from scratch

- Model real estate transactions for various asset types and solve for key investment metrics evaluated by real estate firms

- Increase your speed and efficiency in Microsoft Excel by learning powerful tools and functions

- Master the foundational analytical and financial modeling tools necessary to enter the real estate private equity industry and effectively model deals.

| Course | The Real Estate Financial Modeling Bootcamp |

| Provider | Udemy |

| Instructor | Justin Kivel |

| Time Commitment | 9 hours |

| Enrollment | 41K |

| Rating | 4.8 (10K) |

| Certificate | Available, paid |

Best Options Trading Course for Beginners (projectfinance)

Options Trading for Beginners (The ULTIMATE In-Depth Guide) is a course designed for beginners to learn the fundamentals of options trading. Provided by projectfinance, a YouTube channel dedicated to educational videos on option trading, this free course covers essential topics such as option characteristics, call and put options, shorting options, implied volatility, and more.

In this course, you will:

- Gain a solid understanding of basic option characteristics, including expiration, strike price, and contract multiplier

- Learn about call options through practical examples, such as using a house or trading TSLA options

- Explore put options and their applications, including an example with IWM options

- Understand the components of option prices, including intrinsic and extrinsic value

- Discover the concept of shorting options and its implications, illustrated with examples of short call and short put options

- Gain insights into implied volatility and its impact on options

- Learn about expiration, exercise, and assignment of options

- Consider factors such as liquidity and volume when selecting options to trade

- Get a demonstration of the tastyworks trading platform, including buying and shorting calls/puts, analyzing volume and open interest, trade execution best practices, and more.

| Course | Options Trading for Beginners (The ULTIMATE In-Depth Guide) |

| Provider | YouTube |

| Channel | projectfinance |

| Instructor | Chris |

| Time Commitment | 3 hours |

| Views | 17M |

| Thumbs up | 240K |

| Certificate | None |

Why You Should Trust Us

Class Central, a Tripadvisor for online education, has helped 80 million learners find their next course. We’ve been combing through online education for more than a decade to aggregate a catalog of 250,000 online courses and 250,000 reviews written by our users. And we’re online learners ourselves: combined, the Class Central team has completed over 400 online courses, including online degrees.

How We Made Our Picks and Tested Them

Trying to find “the best” can be daunting, even for those of us who live and breathe online courses. Here’s how I approached this task.

First, I combed through Class Central’s Catalog and the internet to find a variety of free and paid courses.

Second, when choosing courses, I considered the following factors:

- Renowned Institutions: I picked the most recognized institutions in Finances.

- Instructor experience: I looked for instructors with extensive experience in Personal Finance and Investment.

- Course content: I looked for courses that covered a wide range of topics, from the basics to more advanced techniques.

- Student reviews: I read student reviews (when available) to get a sense of the quality of each course.

To evaluate each course, I watched some of the course videos and read the course syllabus. I also looked at the course’s rating and reviews on Class Central.

Ultimately, I used a combination of data and my own judgment to make these picks. I’m confident these recommendations will help you develop the skills and confidence to make informed and profitable investment decisions in different market scenarios and conditions.