Are ISAs Affordable? Analysis of Lambda School’s ISA Shows an Estimated Interest Rate of 87%

Lambda’s ISA comes with a cost for students: an interest rate estimated at 87% for the students that land jobs after graduation.

Buzzy coding bootcamp Lambda School was hyped as a pioneer of Income Share Agreements (ISAs), a type of education financing where students agree to pay a percentage of their future income in exchange for education today. But Lambda’s ISA comes with a cost for students: an interest rate estimated at 87% for the students that land jobs after graduation.

Collateralized Debt Obligations for People:

Lambda School’s ISA has two components: the agreement between Lambda School and students, and the agreement between Lambda School and its financing partners. The student side of the ISA is relatively straightforward. Students agree to pay 17% of their income during months where they earn more than $4,167 per month, for a maximum of 24 months. The total amount students can pay is capped at $30,000, and the contract lasts for five years (if a student goes for five years making less than $4,167 per month, they don’t owe anything). While the terms are somewhat convoluted, the underlying idea is relatively simple (pay 17% of your income), which allows Lambda School to use its ISA as a marketing tool.

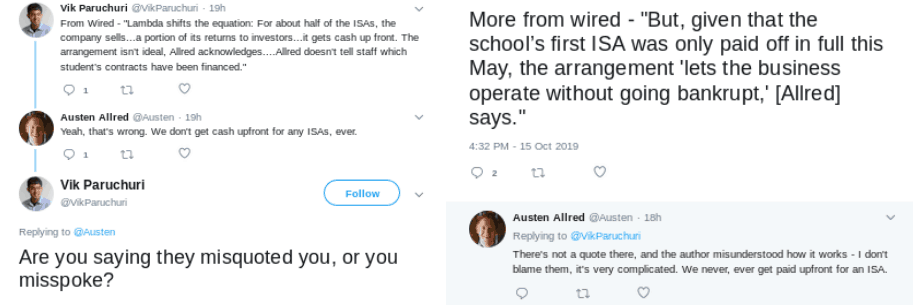

However, until recent exposes from the media, the arrangements between Lambda School and its financing partners were very opaque. Lambda School had offered very general statements about how its ISA worked, such as “we only get paid when you do,” but had declined to describe in detail its financing arrangements with organizations like Leif. Thanks to excellent reporting by New York Magazine, there is now evidence that “as recently as August 2018, a hedge fund paid $10K per ISA to purchase half of Lambda School’s ISAs,” which obviously contradicts many of the claims Lambda School has made about being financially incentivized to place their students in high paying tech jobs.

In response to the New York Magazine article, Lambda School announced a significantly more complicated financing deal with Edly. The announcement was surprisingly condescending—the author said the announcement included more detail “than students need to understand”—but it also is questionable whether the financing arrangement described is materially different from selling the ISAs. One financial commentator, Matt Levine, wrote that “in the downside case, it does kind of look like Lambda is just selling the ISAs” after examining the details of the deal between Lambda and Edly.

However, concerns about incentive alignment are a bit of a red herring. Lambda School has been around since 2017, and appears to place about 50% of its enrolled students into jobs. If Lambda had the capability to improve its student outcomes, that should have happened by now. Whether Lambda is financially incentivized to place more of its graduates is besides the point if Lambda does not have the ability to do so.

Modeling the Lambda-Edly Deal:

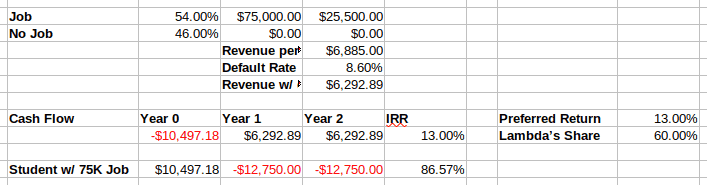

According to internal documents from Edly (first reported on by Bloomberg), 54% of enrolled Lambda students with ISAs will get jobs, where they will earn an average of $75,000 a year. Students that keep current on their ISA payments will pay 17% of that $75,000 for two years, which comes out to $12,750 a year or $25,000 in total. Those payments end up being split into four different buckets. A portion of the $12,750 will go towards paying the investors in Lambda School’s ISA, a portion will go towards the students who default on their ISA (i.e. who miss payments), a portion will go towards paying for the education of students who don’t get jobs (who, under an ISA, don’t make payments), and a portion will go towards the education of the students who get jobs and actually pay the ISA.

Taking into account students who don’t pay, for the average student in the average year, Lambda School will earn $6,293 per year for two years. (The $6,293 figure comes from multiplying $12,750 by 0.53 [the probability that students will get jobs] and by 0.086 [the default rate, which Edly defines as “total $ overdue uncollected payments divided by total $ of payments owed from ISAs on the Lambda School balance sheet”].) Lambda School then seeks to finance this cash flow by bundling ISA contracts into tranches, and then getting money for the tranches through Edly.

Lambda’s deal with Edly has three parts. First, Lambda receives a “performance adjusted advance,” the amount of which Lambda does not disclose to the public. Then, Lambda pays investors back the return plus interest, which according to internal Edly documents is 13%. Finally, if the ISAs do better than expected, Lambda splits the proceeds after 13% interest with investors 60-40.

The advance Lambda gets for the ISAs is not going to be significantly greater than approximately $10,497. Since a Lambda School ISA generates $6,293 per year on average, an advance of $10,497 gives the ISAs an IRR of 13% (figure 1). If Lambda were to get an advance greater than $10,497, then Lambda would likely not be able to pay its investors the 13% interest rate, let alone the 40% of any residual revenue. In practice, Lambda’s advance is likely lower than $10,497, to guard against the returns from the ISA being lower than expected. But since neither Lambda nor Edly have provided much transparency about how the advance is calculated, $10,497 works as a benchmark.

Figure 1: Cash Flow Analysis of Lambda School’s ISA

An Estimated 87% Interest Rate:

With an advance of less than $10,497, Lambda School’s ISA becomes not dissimilar to a payday loan: predatory loans that use high interest rates to trap borrowers in cycles of poverty. Most borrowers don’t pay (46% of Lambda students don’t get jobs, and many of those who do don’t make ISA payments). However, the 54% of borrowers who do get jobs making an average of $75,000 per year will pay $12,750 per year for two years. This is an IRR of 87% (figure 1), meaning that taking out a Lambda School ISA is the equivalent of taking on a loan with an 87% interest rate. As the $10,497 estimate for the advance is an upper bound, the actual interest rate of Lambda School’s ISA is likely higher. For context, an 87% interest rate is significantly higher than the interest rate for a federal student loan (4.53%) or the interest rate of private student loans targeted at bootcamps (a Thinkful Skills Fund loan has an APR of 11.16%).

Lambda School has gone to great lengths to discourage comparisons between its ISA and loans. In Lambda School’s FAQ, Lambda School claims that “the income share agreement has no interest,” and the example ISA available on Lambda School’s website tells students that “this agreement does not constitute a loan” in all caps. Whether Lambda School’s ISA constitutes a loan is legally uncertain, and Lambda School has every incentive to avoid comparisons between loans and ISAs. Some regulators, such as the BPPE which regulates for-profit schools in California, have indicated that if ISAs were considered loans they would violate key consumer protection laws. For prospective students, Lambda’s claim that its ISA has no interest rate makes it difficult, if not impossible, to compare the affordability of the ISA to the affordability to student loans. Given the estimated interest rate of Lambda School’s ISA, which appears to be extraordinarily high, there is ample justification for regulators to take a closer look at ISAs and similar products, particularly with regards to whether ISAs should be regulated the same way loans are.

The estimated value of the advance—$10,497—raises important questions about how much a Lambda education is worth. The upfront tuition advertised on Lambda School’s website—$30,000—is the same amount as the cap on Lambda School’s ISA. For context, the average bootcamp charges $11,900. One advantage of setting upfront tuition at $30,000 is that it makes the ISA look reasonable by comparison, because students with the ISA will pay less than or the same amount as students who pay upfront. But the high price of the upfront tuition relative to the estimated advance Lambda receives for its ISAs makes it unlikely that upfront tuition reflects the true value of a Lambda education.

Are ISAs a Good Deal for Investors?

Investors should be wary of Lambda School’s ISA offering for a number of reasons. Lambda School is alleged to have fraudulently inflated its student facing metrics, which places doubt on any metrics Lambda School produces. Lambda School has also come under heavy scrutiny from the press, so investing in Lambda School is risky from a public relations standpoint. Lambda School is operating without the approval of the state of California, which raises the prospect of legal action.

However, the biggest risk is the prospect of student defaults. Lambda School often releases students from their ISAs, which is very unusual for a for-profit school. Given the lack of regulation of ISAs, there are questions to be asked about Lambda School’s ability to enforce its contracts if students refuse to pay. Absent a clear answer to the question of what mechanisms are available for instances where students don’t make ISA payments, any investments in Lambda School ISAs are incredibly risky.

Are ISAs a Good Deal for Students?

Any loan with an interest rate of 87% and where at least 46% of borrowers don’t pay would be lambasted as predatory. Lambda School’s ISA is much less affordable than comparable loans, such as the Thinkful Skills Fund loan, which has an APR of 11.16%. Lambda School frequently portrays its ISA as a way of “eliminating risk” for students, and it’s true that if only 54% of students get jobs there is substantial risk in attending Lambda School. Fundamentally, if the quality of Lambda’s education was better, then there would be less of a need to “de-risk” it using ISAs. The recent scrutiny ISAs have drawn from presidential candidate Senator Elizabeth Warren is encouraging. As the Trump administration moves to make ISAs widely available, there is a pressing need for increased scrutiny of ISAs from regulators consumer protection advocates.

Want to learn more about bootcamps and ISAs? Take a look at Class Central’s comprehensive report on the industry.

Christopher Johnston

I attended Lambda and did not finish. The decision to not complete was not mine but forced on me by Lambda. While I’m unhappy with the decision, I think your analysis of this misses an important part of the ISA.

If you don’t get a job in the industry AND making more than 50,000 (in a 5-year period after finishing) you don’t pay anything.

Meaning if you start a photography business and make $100,000/yr you don’t have to pay any of that to Lambda because it isn’t in the software industry.

The risk for a student is low. If you were making, say 20,000/year, and go to Lambda and finish and get a job making, say 85,000/year, your quality of life increased substantially. If you don’t get a job you pay nothing. if you get a job you pay 17% of your income for 24 months or until pay 30,000 (whichever is LESS).

I have student loans and I didn’t get a job in my industry and I still have to pay them, no matter what. If it takes 10 years, 20 years, or 30 years there is no out. If I don’t pay them they can garnish my wages or hijack my tax refund. I don’t see in any way how that is better than the ISA.

Ligma

1. Equating the advance rate with what it costs Lambda School to train a student / the value the student gets is quite sloppy. I recommend reading about how the income statement and balance sheet are linked.

2. It makes sense that a de-risked (you don’t have to pay if you don’t get a job) financial obligation would have a higher cost…because there’s less risk. I recommend reading about risk/reward trade off concepts.

3. ISAs have a short time horizon so performance data aligns incentives like any other asset class. Investors losing money is bad for them so they won’t give any more money if they lose money.

Doing analysis like these are great ways to explore advanced financial concepts! However, learning elementary / foundational concepts can help inform better written articles. Advanced finance concepts all seem less nefarious once you grasp the basic building blocks! Lmk if you want any specific book recommendations.

Bill

Another scenario to consider is: Someone goes to lambda, doesn’t get a job, but still, if they get one in the next FIVE YEARS, they are still liable for paying. Five years is a long time. One can become very qualified for many programming jobs in that time on their own, yet still owe lambda for the measly 6 months of training that happened up to five years ago