6 Best Personal Finance Courses for 2025

Take Control of Your Finances: From Emergency Funds to Retirement Planning, and Risk Management.

Take control of your financial life with experts and renowned institutions. Our guide features the best personal finance courses, offering insights and strategies from real-world financial professionals. While all the courses (except one group from the UK) are focused on the US market, most of the advice can be applied in any market – except taxes and specific product recommendations.

Whether you’re starting to save, reevaluating debts, managing investment risks, or planning for retirement, this Best Courses Guide (BCG) caters to your needs. We’ve selected the best courses for you from over 500 Personal Finance courses in our catalog. From starting an emergency fund to navigating complex investment decisions, there’s a course for you.

Click on the shortcuts for more details:

Here are our top picks

| Course Highlight | Workload |

| Best Personal Finance Course for Beginners (SoFi) | 44 hours |

| Also Great Personal Finance Course for Beginners (Udemy) | 16 hours |

| Best University-level Finance Course (University of Michigan) | 30-36 hours |

| Best University-level Budgeting and Tax Planning Course (Indiana University) | 16-24 hours |

| Short Personal Finance Course for Freelancers (Skillshare) | 1-2 hours |

| Best Personal Finance Courses for UK Market (OpenLearn) | Various |

BCG Overview

- 4 courses are free or free-to-audit and 2 are paid

- OpenLearn courses offer a free certificate of completion

- The most featured provider is edX with 2 courses.

Best Personal Finance Course for Beginners (SoFi)

Taught by two CERTIFIED FINANCIAL PLANNER™ Professionals, The Fundamentals of Personal Finance Specialization is perfect for learners at any stage, whether starting college, approaching retirement, or navigating the challenges of mid-life finances. It’s structured into five courses, each focusing on critical aspects of personal finance. The readings, videos, and activities will help you understand your financial situation and guide you toward your goals.

To access the free-to-audit option, visit each course page linked below. For more information, see A Guide on How to Sign up for Coursera Courses for Free.

- Introduction to Personal Finance covers budgeting, credit scores, cash flow, and financial goal setting.

- Saving Money for the Future focuses on understanding the importance of compounding growth and setting savings goals.

- Managing Debt covers different types of debt, repayment strategies, and understanding good vs. bad debt.

- Fundamentals of Investing covers investment vehicles, risk tolerance, diversification, active vs. passive investing, investment fees, and taxes.

- Risk Management in Personal Finance covers insurance (various types), estate planning, and special considerations for new parents.

| Course | The Fundamentals of Personal Finance |

| Provider | Coursera |

| Institution | SoFi |

| Instructor | Brian Walsh and Lauren Anastasio |

| Time Commitment | 44 hours |

| Enrollment | 14K |

| Rating | 4.6 (206) |

| Cost | free-to-audit |

| Quizzes/Assessment Items | Yes |

| Certificate | Paid |

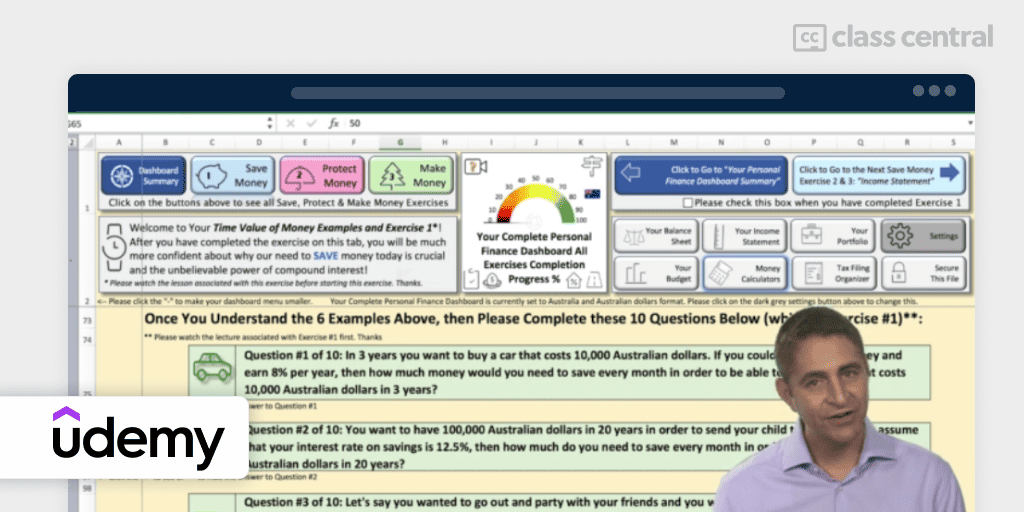

Also Great Personal Finance Course for Beginners (Udemy)

If you want to strengthen your financial understanding and money management skills, “The Complete Personal Finance Course: Save, Protect, Make More” is for you. Led by the acclaimed professor Chris Haroun, this course focuses on the three pillars of personal finance: saving, protecting, and investing your money.

- Saving Money:

- Analysis and reduction of personal expenses to boost long-term net worth.

- Over 100 practical methods for effective money saving.

- How small habitual savings can create wealth over time.

- Protecting Money:

- The financial strategies of billionaires.

- Improving your credit scores.

- Wills, trusts, estate planning, and budget creation.

- Tax filing and retirement account management.

- Reducing taxes for long-term net worth growth.

- Insurance products to secure family and assets.

- Understanding and enhancing net worth.

- Investing Money:

- Investing in stocks, bonds, commodities, and real estate.

- Creating a diversified investment portfolio.

- Minimizing fees paid to banks and investment firms.

| Course | The Complete Personal Finance Course: Save, Protect, Make More |

| Provider | Udemy |

| Instructor | Chris Haroun |

| Time Commitment | 16 hours |

| Enrollment | 155K |

| Rating | 4.6 (11K) |

| Certificate | Paid |

Best University-level Finance Course (University of Michigan)

Explore the world of finance in Finance for Everyone: Smart Tools for Decision-Making course, by the University of Michigan on edX. Guided by Professor Gautam Kaul, a renowned expert in finance from the Ross School of Business, this free-to-audit course is designed to enhance your financial literacy and decision-making skills.

There are no requirements to take this course, although some familiarity with mathematics and basic finance principles is beneficial.

You will learn:

- Financial Decision-Making: Gain insights into making informed financial choices in various aspects of life, from renting vs. buying to evaluating loans.

- Time Value of Money: Understand this concept and its applications in everyday decisions.

- Understanding Finance: Develop an appreciation for the role of finance in the world around us.

- Decision-Making Frameworks: Learn various frameworks for making sound financial decisions in personal and professional contexts.

- Practical Tools: Acquire skills in using financial tools for effective decision-making.

| Course | Finance for Everyone: Smart Tools for Decision-Making |

| Provider | edX |

| University | University of Michigan |

| Instructor | Gautam Kaul |

| Time Commitment | 6 weeks long, 5-6 hours a week |

| Enrollment | 89K |

| Class Central Rating | 4.6 (5) |

| Cost | $59.00 (free-to-audit) |

| Quizzes/Assessment Items | Yes |

| Certificate | Available |

Best University-level Budgeting and Tax Planning Course (Indiana University)

Introduction to Personal Financial Planning, offered by Indiana University through edX, is designed to enhance your financial literacy and planning skills. Under the guidance of Instructor Todd Roberson, this free-to-audit course provides the foundational knowledge necessary to build a secure financial future.

In this course, you will learn:

- Personalized Financial Planning: Develop a financial plan tailored to your goals using a comprehensive, step-by-step approach.

- Financial Planning Essentials: Understand key concepts like income statements, balance sheets, and budgeting.

- Tax Planning and Wealth Management: Explore how taxes impact personal wealth and learn strategies for effective tax planning.

- Cognitive Skills for Financial Decisions: Identify and navigate common biases and errors in financial decision-making.

- Practical Application and Resources: Access valuable financial planning tools and resources, and apply learned concepts to real-life scenarios.

- Understanding Financial Satisfaction: Deepen your insight into how financial decisions impact personal satisfaction and well-being.

Engaging and practical, the course incorporates videos, short readings, and self-paced activities. It is designed to build practical money management skills, deepen understanding of financial planning concepts, and illustrate how personal financial planning contributes to a fulfilling life.

| Course | Introduction to Personal Financial Planning |

| Part of | Personal Finance Professional Certificate |

| Provider | edX |

| Institution | Indiana University |

| Instructor | Todd Roberson |

| Time Commitment | 4 weeks long, 4-6 hours a week |

| Enrollment | 31K |

| Cost | $199.00 (free-to-audit) |

| Quizzes/Assessment Items | Yes |

| Certificate | Available |

Short Personal Finance Course for Freelancers (Skillshare)

Modern Money Habits: 5 Steps to Build the Life You Want is taught by Justin Bridges, a fashion photographer with a unique financial journey from Wall Street to the world of photography. In just 70 minutes, Justin shares a straightforward, five-step approach to financial mastery, combining the practical advice that has resonated with over 40,000 Skillshare students.

What you’ll learn:

- Financial Self-Awareness: Gain insights into your spending habits to live intentionally.

- Redefining Success: Find peace by aligning financial goals with your personal priorities.

- Emergency Fund: Discover strategies to create a robust emergency fund, crucial for freelancers and those transitioning careers.

- Debt Management Strategies: Learn small yet impactful changes to manage and prevent debt.

- Retirement Planning: Craft actionable plans for a secure retirement.

- Wealth Building: Develop strategies to accumulate wealth and realize your dreams.

| Course | Modern Money Habits: 5 Steps to Build the Life You Want |

| Provider | Skillshare |

| Instructor | Justin Bridges |

| Time Commitment | 1-2 hours |

| Enrollment | 43K |

| Rating | 99% positive (776) |

| Cost | Subscription |

| Final Project | Yes |

| Certificate | Available |

Best Personal Finance Courses for UK Market (OpenLearn)

OpenLearn offers an array of personal finance courses tailored to the UK market. These courses, combining text-based tutorials with interactive quizzes, are designed to enhance your financial understanding and skills. Completing any of these courses will earn you a free certificate.

Retirement planning made easy (Rating: 4.9, Duration: 4 hours)

- Emphasizes the importance of making sound financial plans for a quality life post-retirement.

- Guides you through the critical decisions and financial strategies to ensure a comfortable retirement.

Managing my money (Rating: 4.3, Duration: 24 hours)

- Learn essential personal finance skills such as managing budgets, debts, investments, property purchase, pensions, and insurance.

- Timely and relevant, considering the current financial climate of rising personal debt and falling real incomes.

Understanding mortgages (Rating: 4.8, Duration: 2 hours)

- Explores various mortgage products in the UK market, including their interest rates and distinctive features.

- Provides insights into making informed choices from the available range of mortgage options.

Managing my investments (Rating: 4.3, Duration: 24 hours)

- A comprehensive guide to different investment choices, covering the returns, risks, and historical performance of each.

- Discusses investment strategies and the practical aspects of engaging in personal finance markets.

- Highlights how to circumvent behavioural traits that can hinder effective investment decision-making.

Why You Should Trust Us

Class Central, a Tripadvisor for online education, has helped 80 million learners find their next course. We’ve been combing through online education for more than a decade to aggregate a catalog of 250,000 online courses and 250,000 reviews written by our users. And we’re online learners ourselves: combined, the Class Central team has completed over 400 online courses, including online degrees.

How We Made Our Picks and Tested Them

Trying to find “the best” can be daunting, even for those of us who live and breathe online courses. Here’s how I approached this task.

First, I combed through Class Central’s Catalog and the internet to find a variety of free and paid courses.

Second, when choosing courses, I considered the following factors:

- Renowned Institutions: I picked the most recognized institutions in Finances.

- Instructor experience: I looked for instructors with extensive experience in Personal Finance and Financial Planning.

- Course content: I looked for courses that covered a wide range of topics, from the basics to more advanced techniques.

- Student reviews: I read student reviews (when available) to get a sense of the quality of each course.

To evaluate each course, I watched some of the course videos and read the course syllabus. I also looked at the course’s rating and reviews on Class Central.

Ultimately, I used a combination of data and my own judgment to make these picks. I’m confident these recommendations will help you achieve your short-term financial goals and ultimately, your financial independence.

g2b

Hey Fabio, Great name btw. I am an old lady of 64. I retired from the military, worked as a contractor for several years and since 2015 I am working as a govt civil service employee. My husband and I bought a house in 2016 and now face a mortgage at our age when most people have their homes paid for. I would really like to retire someday but fear risk taking finances are really not smart at this point in my life. So I would like very much to educate myself on estate planning, trusts / trust funds for my adult children, and no financial burden but live a minimal/comfortable life. What advice do you have for an old woman. Thanks g2b