A Decade of MOOCs: A Review of MOOC Stats and Trends in 2021

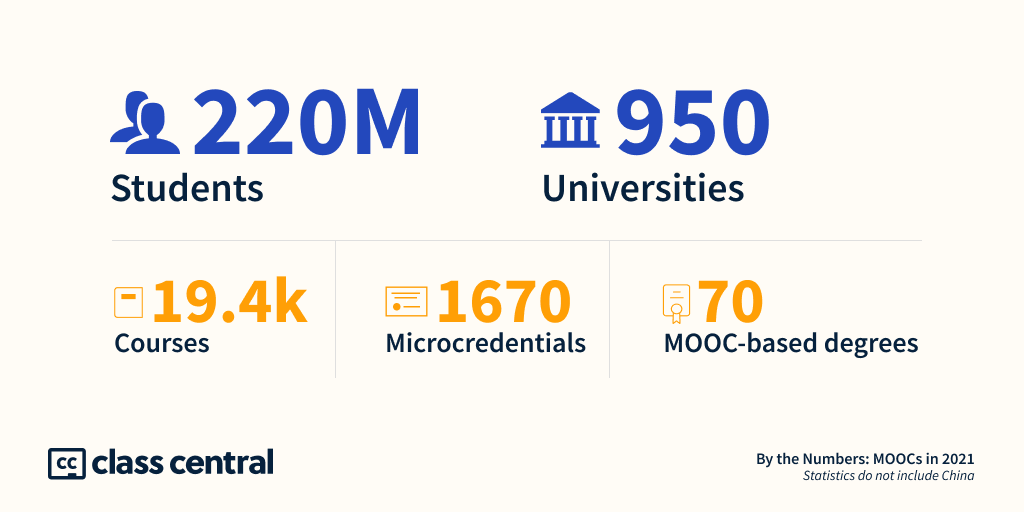

In 2021, 10 years after it burst on the scene, the MOOC ecosystem has reached 220M learners and 19.4K courses.

In 2021, two of the biggest MOOC providers had an “exit” event. Coursera went public, while edX was acquired by the public company 2U for $800 million and lost its non-profit status.

Ten years ago, over 300k learners were taking the three free Stanford courses that kicked off the modern MOOC movement. I was one of those learners and launched Class Central as a side-project to keep track of these MOOCs.

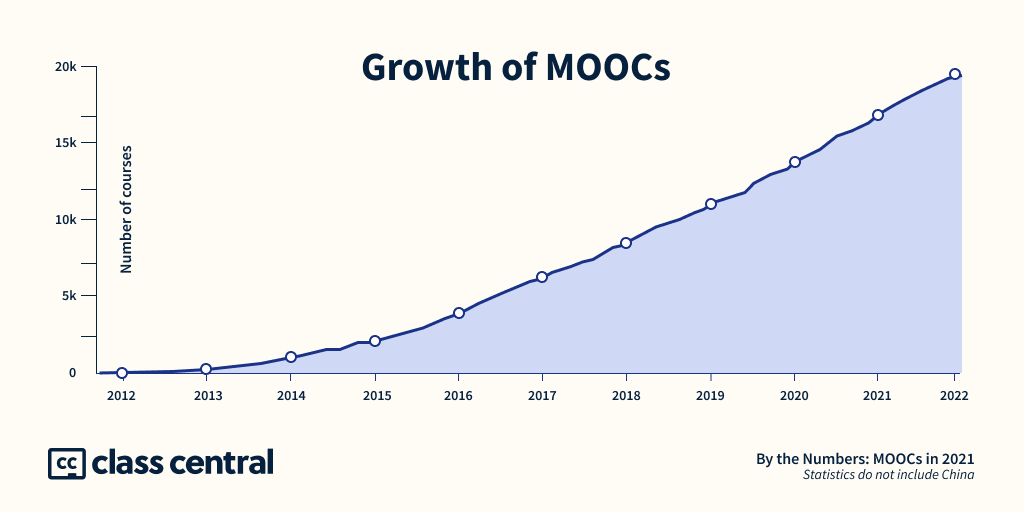

Now, a decade later, MOOCs have reached 220 million learners, excluding China1. In 2021, providers launched over 3100 courses and 500 microcredentials.

Exits

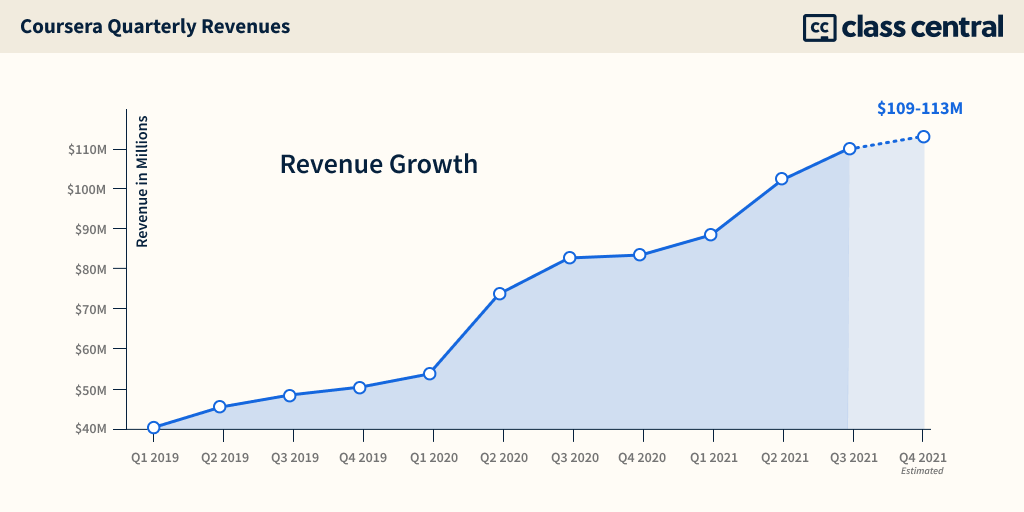

In March, Coursera went public on the NYSE, raising $519 million. Since then, its stock price has been steadily falling even though revenue has been increasing. It is expected to make $400+ million in 2021, while losing well over $100 million.

The IPO gave us an opportunity to learn more about the company. I read through the 240-page IPO prospectus and discovered interesting details like Rhyme’s acquisition cost, Andrew Ng’s DeepLearning.AI revenue, and how much Coursera paid its university partners. You can find the in-depth analysis here.

In July, edX unexpectedly got acquired by 2U for $800 million in cash and lost its non-profit status. The deal went through last month and edX CEO Anant Agarwal has transitioned to ‘Chief Open Education Officer’ at 2U.

In my opinion, which I shared in a 4,500-word analysis, this acquisition weakens edX since it takes away its biggest (or probably only) advantage over Coursera — an ideological one at that: its non-profit status.

So far none of the edX Consortium members have left, while two dozen of 2U partners have joined edX. EdX has also waived all the membership and annual fees for its members.

We’ve already seen the first signs of integration. EdX has started promoting other 2U acquisitions through edx.org: GetSmarter Courses and Trilogy Bootcamps.

2U’s acquisition of edX hasn’t had a positive impact on the 2U stock price. It’s lower than it was before the acquisition. At the time of writing, the company is valued at ~$1.6B.

Looking Beyond Universities

Originally, MOOC providers relied on universities to create courses. But that dependence is declining as more and more of the courses are created by companies every year. These include tech giants like Google, Microsoft, Amazon, and Facebook.

| 2020 | 2021 | |

| Coursera | 31% | 39% |

| edX | 16% | 26% |

| FutureLearn | 38% | 51% |

Class Central analyses show that the fraction of new non-university courses created on Coursera increased from 31% in 2020 to 39% in 2021. This count excludes the Coursera Project Network courses, which are created by professionals. Taking those into account, the majority of the new courses launched on Coursera in 2021 are not from universities anymore.

A similar thing happened at FutureLearn. In 2021, they introduced their first subscription-based ExpertTracks. Only one out of every three ExpertTracks are produced by universities.

Post-Pandemic Slowdown

In last year’s analysis, I talked about the Quarantine Boost experienced by online course providers, and more specifically, MOOC providers. It led me to call 2020 the “Second Year of the MOOC”.

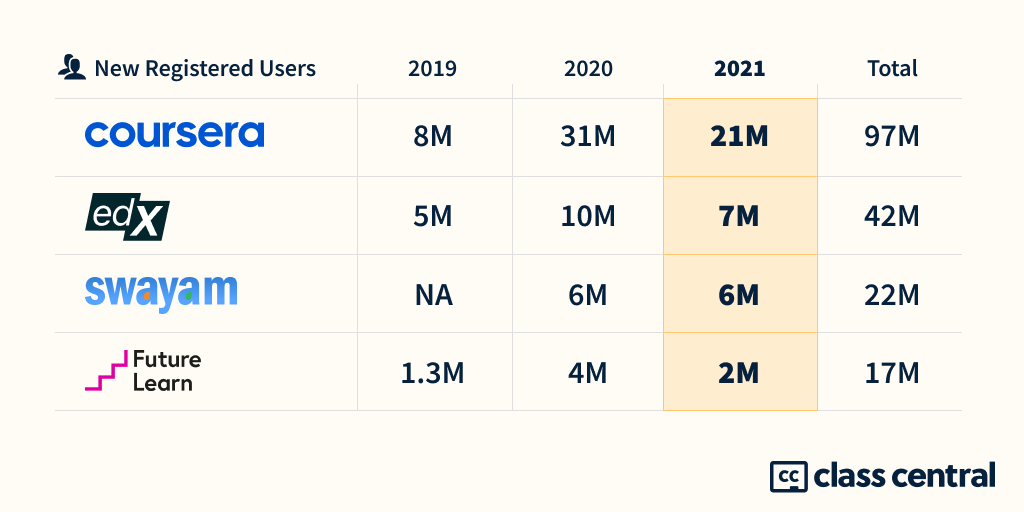

In terms of new learners, the boost has to some extent faded. In 2021, 40M new learners signed up for at least one MOOC, compared to 60M in 2020.

But Coursera has done much better than its nearest MOOC competitors in maintaining the pandemic boost. It added 21M new learners, which is less than the 31M from 2020, but more than twice the 8M they gained in 2019.

A Decade of MOOCs

MOOCs started out with a promise of free education for everyone everywhere. But over time the definition of free changed. They went from “free” to “free to audit”.

They were born without a business model and within a decade, MOOCs went from no revenue to making well over a half a billion dollars annually. Fuelled by hype in its early years, an entire industry was spawned within providers across the world, including a few national platforms.

I took one of the very first MOOCs, and back then, the videos, assignments, and certificates were all free. As MOOC providers focused on finding a business model, certificates and graded assignments moved behind paywalls. All the top MOOC providers also have completely paid courses.

Providers also tweaked the scheduling, so that courses are available throughout the year rather than having intermittent start dates, so learners can start them immediately. Scaling MOOCs required removing professors from the active role of running their courses.

This also killed one of the earliest selling points of MOOCs: the community. MOOCs are now no longer massive.

They found their audience (at least from a monetization perspective): Professional Learners — that is, learners taking courses for potential career benefits. To target them, providers launched 70 online degrees and ~17k microcredentials.

Just as MOOC providers hit a wall when it came to accelerating user acquisition (i.e. they began to gain a similar number of new learners year over year), the pandemic gave them a shot in the arm. In terms of growth, it allowed them to skip forward in time, gaining in months what would have taken a couple of years in the absence of the pandemic.

This accelerated Coursera’s plans to go public. And edX, feeling they couldn’t compete with Coursera without additional resources, decided to get acquired.

In 2021, providers are looking beyond universities to create courses. The pandemic also increased the adoption of online courses from Corporations and Governments around the world. This is where they are (and will be) looking for growth over the next few years.

For Coursera, Enterprise is already its fastest growing segment, with 70% year-over-year growth, compared to 29% for Consumer.

You can find a complete overview of how MOOCs did this year in Class Central’s analysis By The Numbers: MOOCs in 2021. And you can learn more about individual MOOC providers in our 2021 end-of-year series:

- Coursera’s 2021: Year in Review

- EdX’s 2021: Year in Review

- FutureLearn’s 2021: Year in Review

- Udacity’s 2021: Year in Review

[1] We decided to leave China out of our analysis because, as we learned more about Chinese online education, we realized that the metrics we’d like to present are: (1) sometimes unavailable, (2) sometimes available but impossible to validate to the extent we’d like, (3) sometimes reflect a view too narrow to adequately capture the overall state of MOOCs in China.

Tags

Jaime Calderón-Soto

Thank you very much for this post. It is very useful and informative for research and education purposes. I would like to see in future reports information about areas of knowledge, careers, or specialization courses available through MOOC offerings. As well as some demographics of their users/students. Access and graduation rates are also important measures to compare with traditional universities. Thanks again for your work.