Coursera Q1 2021: $88.4M Revenue, 5M learners, 13.5K Degree Students

Coursera has shared its first quarterly report since going public. Here’s the rundown.

Last week, Coursera announced its first quarterly report since going public in late March. In Q1 2021, Coursera earned $88.4 million in revenue and lost $18.7 million.

Compared to Q1 2020, Coursera showed strong growth in its three different business units: Consumer, Enterprise, and Degrees. 5 million new learners joined the platform in Q1 2021, taking the total to 82 million.

But when markets closed on Friday, the stock price had dropped to $36.14. On March 31, the day it went public, Coursera closed at $45.

Unlike Coursera’s IPO Prospectus (aka S-1 form, which I analyzed here), Coursera’s quarterly report (aka 8-K form) doesn’t provide nearly as much information. So I’ll combine information from the S-1 and 8-K to give a fuller picture.

Revenues & Estimates

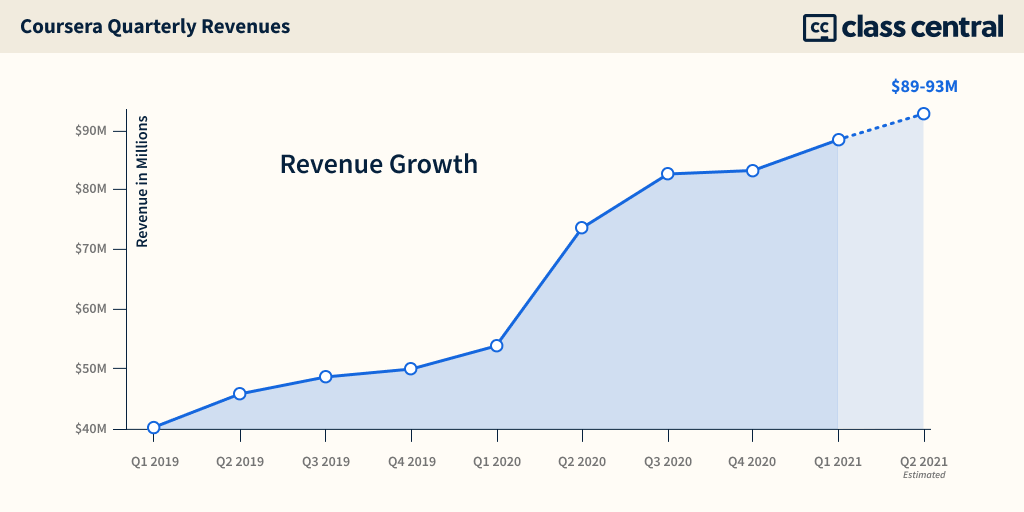

In this quarterly revenue graph, the pandemic bump in Q2 2020 can be clearly seen.

In Q1 2021, Coursera made $88.4 million, up 64% from the $53.8 million they’d made a year earlier. In Q3 and Q4 2020, they made $82.7 million and $83.2 million, respectively. The company estimates that in Q2 2021, their revenues will be in the $89–$93 million range.

In their 8-K form, Coursera didn’t explicitly break down their Q1 2020 stats for individual business segments, but they did mention growth rates, which I used to calculate the actual revenue numbers.

| Q1 2020 | Q1 2021 | |

| Revenues | $53.8m | $88.4m |

| Consumer | $32.2m | $51.9m |

| Enterprise | $15m | $24.5m |

| Degrees | $6.62 | $12.1m |

| Losses | $(14.3)m | $(18.7)m |

The company expects their 2021 revenue to be in the $369 – $381 million range with an adjusted EBITDA in the $(45.5) – $(52.5) million range. Below is a breakdown of how they’ve done over the last few years (taken from their S-1).

| Revenue | 2017 | 2018 | 2019 | 2020 |

| Total | $95.6m | $141.8m | $184.4m | $293.5m |

| Consumer | $85.7m | $107.5m | $121m | $193m |

| Enterprise | $7.4m | $26.0m | $48.2m | $70.8m |

| Degrees | $2.5m | $7.4m | $15.1m | $29.9m |

| Net Loss | $(53.3m) | $(43.6m) | $(46.8m) | $(66.8m) |

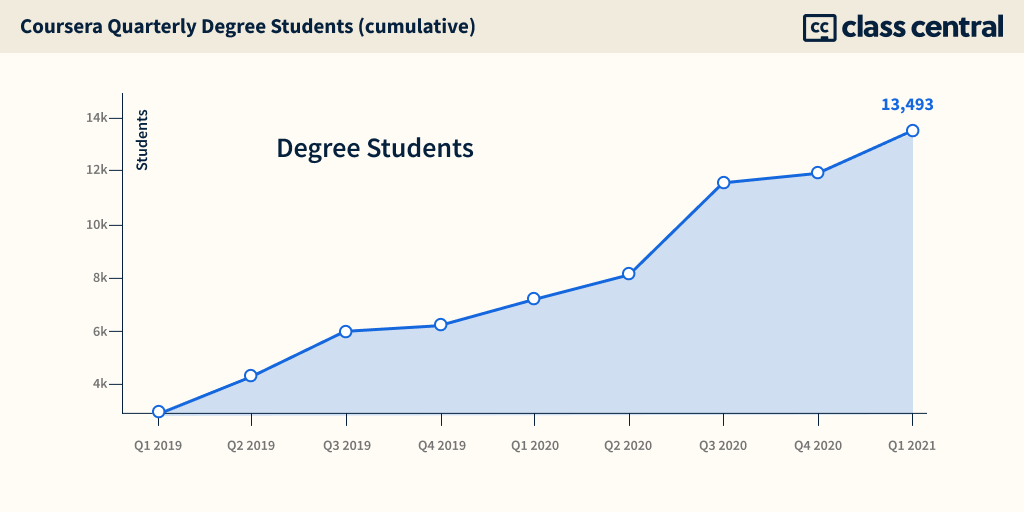

Degree Students

In the first quarter of 2021, Coursera added around 1,600 new degree students, taking the total number to 13,493.

During their recent conference, Coursera announced 5 new degrees, including 3 from its first degree partner in India, and an MBA from Brazil. Coursera has over 30 online degrees on its platform.

During his keynote, Coursera CEO Jeff Maggioncalda shared enrollment numbers for two of Coursera’s popular degree programs:

- 4,500 enrollments and 1,500 graduations in Illinois’ iMBA, Coursera’s first online degree.

- 3,000 enrollments (up from 2,000 in last year’s keynote) in the University of London’s online bachelor’s in computer science.

Below is an overview of how Coursera’s degrees have done over the years (from their S-1).

| No. of Degrees | Revenue | Students | |

| 2016 | 2 | ||

| 2017 | 4 | $2.5m | |

| 2018 | 12 | $7.4m | |

| 2019 | 16 | $15.1m | 6,217 |

| 2020 | 26 | $29.9m | 11,900 |

Early Release IPO Lock-Up Period

Another interesting information I found was that Coursera announced “a partial early lock-up release with respect to Coursera’s common stock, par value $0.00001 per share”.

Coursera’s lock-up period is 180 days, which means Coursera’s common stockholders before the company went public can’t sell their shares for 180 days since the company went public.

But these restrictions will end for 25% of the shares.

“Pursuant to the terms of the lock-up agreements, the lock-up restrictions will end with respect to 25% of the shares (including shares underlying vested RSUs and stock options) owned by the applicable holder as of the date of the lock-up agreement on May 11, 2021, provided that in the case of the lock-up agreements with Coursera’s current executive officers, directors and certain other equityholders, only if certain share price and other conditions are met. The conditions for early release were satisfied on May 4, 2021. Accordingly, Coursera estimates that up to 34.0 million shares will become eligible for sale in the public market at the open of trading on May 11, 2021, subject to applicable restrictions under the Securities Act of 1933, as amended, including Rule 144 and Rule 701.”

Tags