Harvard and MIT’s $800 Million Mistake: The Triple Failure of 2U, edX, and Axim Collaborative

The future of Coursera’s only credible alternative for universities rests in the hands of 2U’s creditors.

In 2021, the unprofitable 2U bought edX, an unprofitable non-profit, for a staggering $800 million. Even to my untrained eye, it seemed like a questionable decision.

In my analysis of the acquisition, I had highlighted the financial strain this acquisition would place on 2U, noting the additional $42 million of annual interest expense due to the loan taken to finance the purchase.

Last month, 2U filed for bankruptcy, primarily due to the significant debt it took on, particularly to finance the acquisition of edX.

Fast forward to 2024, and we’re faced with a harsh reality: 2U is bankrupt, edX seems to have stagnated, and Axim Collaborative (the non-profit from the sale that retained the $800 million) has barely made a peep.

As one of the few voices who expressed skepticism from the outset (in a business sense), I feel compelled to break down this triple failure and the unfulfilled promises that accompanied it.

From Ivy League to Bankruptcy: A Timeline

2021:

- June/July: 2U announces acquisition of edX for $800 million

- November: Acquisition finalized

2022:

- February: 2U stock drops 50% after Q1 earnings report, market cap falls below edX purchase price

- July/August: 2U announces strategy shift centered around edX, including layoffs and cost reductions

- 2U implements “platform strategy” to unify operations under edX brand

2023:

- March: 2U investor day outlines plans for edX including new subscription models and “funnel builders”

- Axim Collaborative announced with a new CEO

- Q3:

- 2U announces disastrous Q3 results

- Market cap falls to less than $80 million

- USC partnership terminated (costing USC $40 million “break fee”)

- Additional layoffs implemented

- CEO Chip Paucek steps down, replaced by CFO Paul Lalljie

- Q4: 2U takes over programs from Pearson’s OPM business

2024:

- January: Another wave of layoffs at 2U/edX

- July: 2U files for Bankruptcy

2U’s Costly Gamble

As we make all of these changes, I’m proud to say that by year’s end we’ll have answered the question from our IPO eight years ago. Yes, you can build a sustainable education business in higher ed at scale.

This quote, made almost a year ago by 2U CEO Chip Paucek, came as he announced a major layoff and the consolidation of different 2U brands under edX. Three months later, he stepped down as 2U CEO and board member.

This type of hubris is something I’ve observed since I began following 2U after their acquisition of edX. 2U envisions a reality that doesn’t exist but acts as if it does.

Here’s an example. In response to a Wall Street Journal article about 2U’s practices (one of many such articles), Paucek wrote a blog post titled “Don’t Let the Skeptic Win.” One line caught my attention: “We’ve helped our partners dramatically lower the cost of their degrees”.

| Masters | Doctorates | |

| Total | 99 | 12 |

| Median Price | $66.5K | $106K |

| Min Price | $34K | $56K |

| Max Price | $126K | $201K |

This claim surprised me because a few months later, I investigated the cost of 2U-powered degrees. I found that 20% of these degrees would cost the learner over $100,000, with the most expensive exceeding $200,000.

I would argue the opposite—2U’s business model required degrees to be as expensive as on-campus degrees. Acquiring students is a significant cost for online degrees, and as a company tries to grow to satisfy investors, it spends more to acquire students.

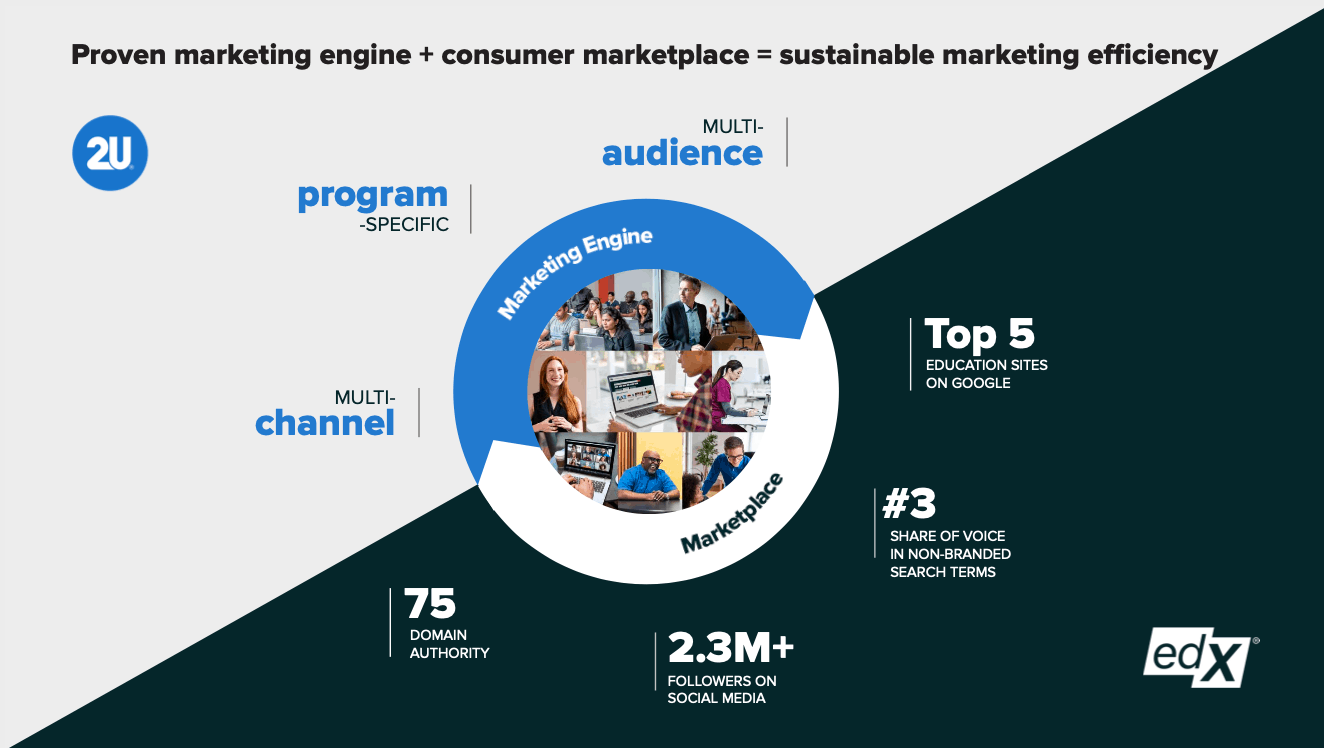

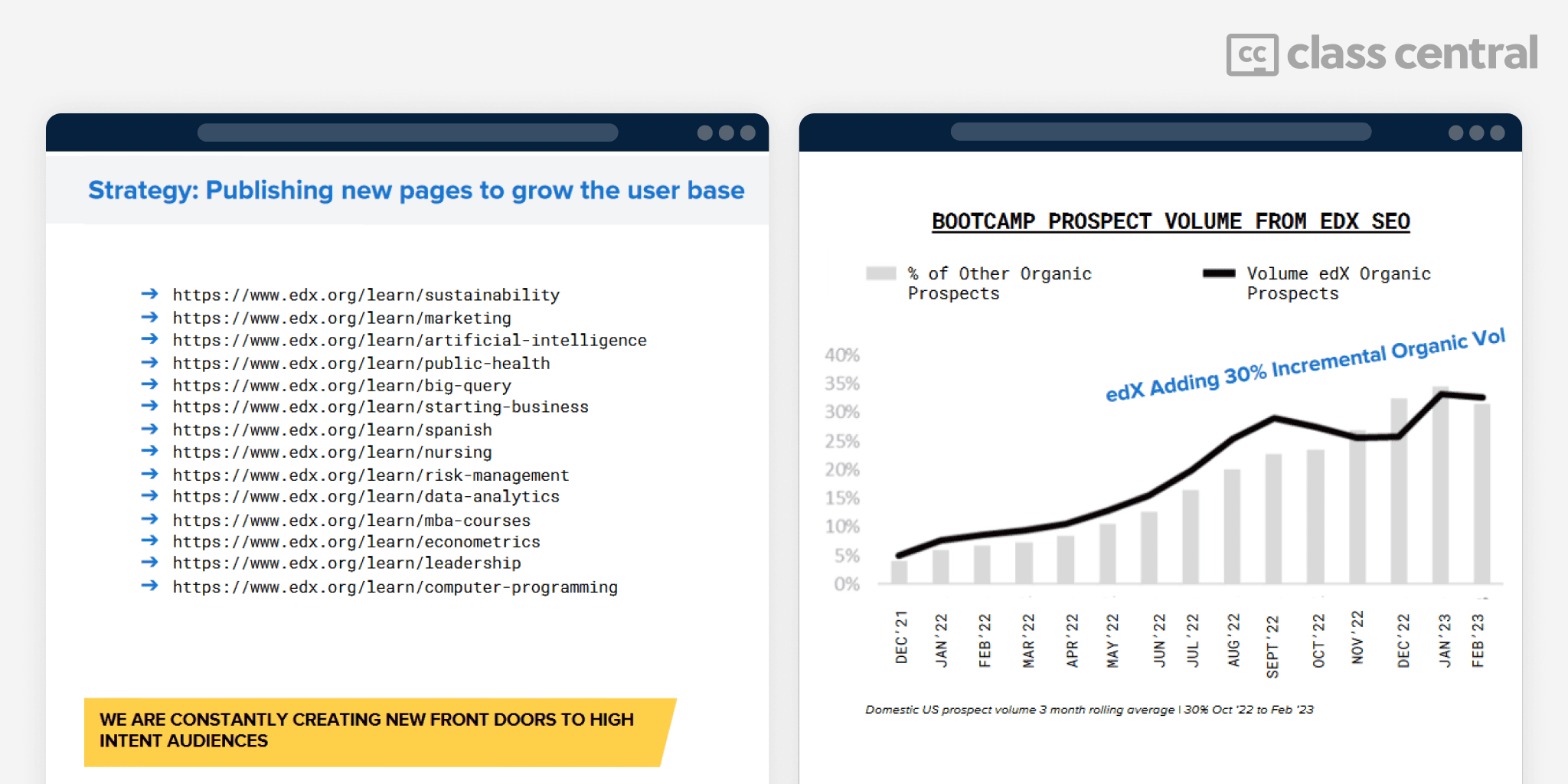

In 2021, 2U spent $456M on sales and marketing, accounting for almost 40% of its expenses. This is why it acquired edX: to optimize these costs and reduce their reliance on paid advertising.

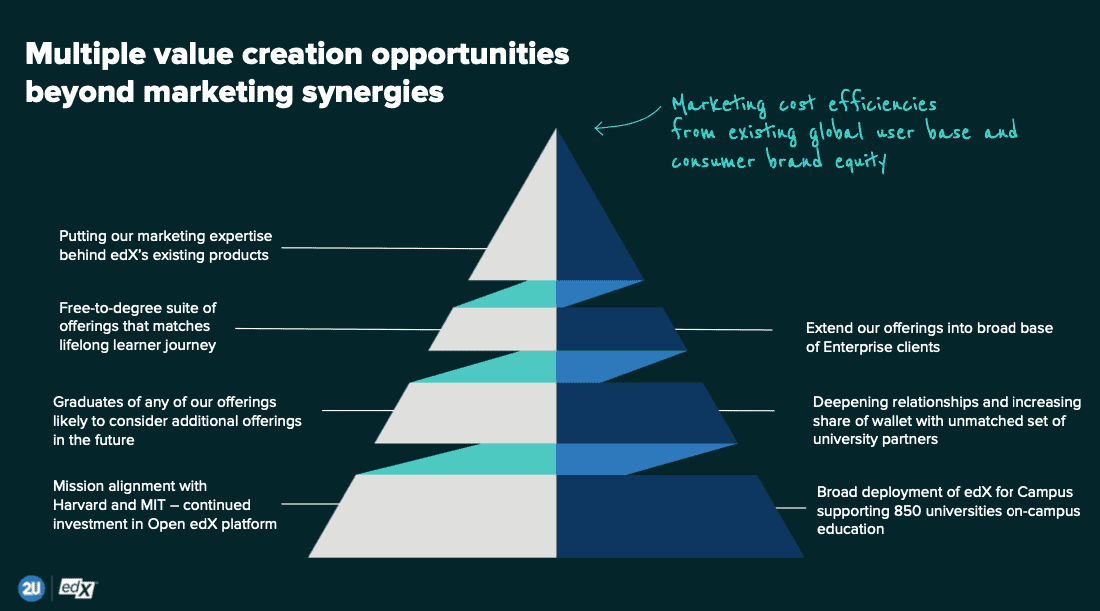

Essentially, edX’s role after the acquisition was to help reduce the cost of acquiring learners for 2U’s various programs: GetSmarter Executive/Professional Education, Trilogy Bootcamps, and 2U-powered online degrees.

Before acquiring edX, 2U’s cost per enrollment was approximately $3,900. They anticipated reducing this cost by 10% by marketing their programs to edX users and would lead to $40–$60M in annual savings.

In my analysis of 2U’s acquisition of edX, I had talked about why this model might not work. I highlighted two key issues: the mismatch between 2U’s high-cost programs and edX’s largely international user base, and edX’s own poor track record in converting learners to their more affordable online degrees

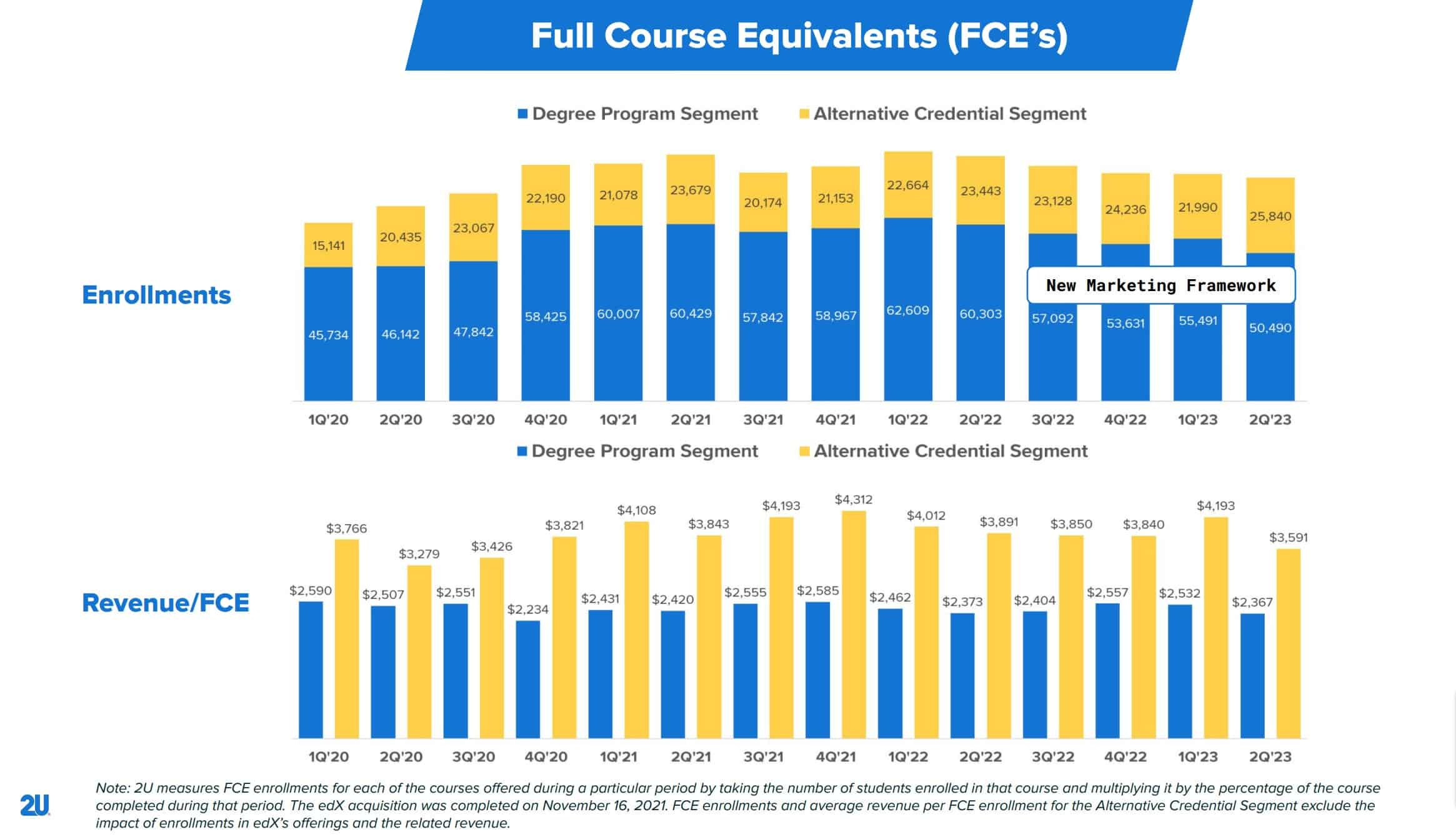

These anticipated savings never materialized. In fact, 2U’s enrollments continued to decline after they implemented the “new marketing framework.”

While they were able to reduce their marketing and sales expenses, this resulted in fewer enrollments. Furthermore, any savings were offset by the annual interest payments on the debt incurred to purchase edX.

This financial burden was so significant that it led to three rounds of layoffs. To generate more cash at the end of last year, 2U resorted to the drastic measure of “Portfolio Management,” terminating certain degree partnerships in exchange for breakup fees. Agreements totaling approximately $150 million were finalized by the end of 2023.

When 2U acquired edX, it painted a rosy picture of reduced student acquisition costs and a “platform strategy” that would revolutionize online education. Reality could not have been more different.

The bankruptcy filing in 2024 was the final nail in the coffin, proving that the edX acquisition was not just a misstep, but a catastrophic error that sank the entire company.

EdX’s Stagnation

“2U’s people, technology, and scale will expand edX’s ability to deliver on our mission and enable all learners to unlock their potential. #freetodegree”

- Anant Agarwal (@agarwaledu) June 29, 2021

As misguided as it was, 2U has been very specific about how edX fits into its plans: reducing their user acquisition costs. That’s why 2U spent $800 million in cash to buy edX. EdX is a marketing channel for 2U.

EdX’s reason, on the other hand, was a bit vague. 2U has some marketing expertise that would somehow help edX catch up to Coursera.

Even before the pandemic, Coursera was increasing the gap between itself and edX. The gap only widened after the pandemic. Coursera gained almost as many learners in 2020 alone as edX did since its launch nine years ago.

I had argued that edX’s rationale for the acquisition was flawed. 2U’s “marketing engine” is built around higher-priced programs involving high-touch activities like sales. This approach is unlikely to benefit the majority of edX’s lower-priced course offerings or help it catch up to Coursera.

Competing with Coursera would require significant investment – potentially hundreds of millions of dollars – which 2U may struggle to provide given its new debt from the acquisition. Even if 2U had the money, it’s unclear why they would take that risk.

2U acquired edX primarily to leverage its marketplace (the website itself) and popular brand to market expensive programs like boot camps and degrees. This is exactly what happened.

Most programs now featured on edX’s homepage were previously 2U offerings. In fact, 2U rebranded their bootcamps as “edX bootcamps.”

The rebranding of Trilogy Education’s (acquired for $750M) boot camps as “edX bootcamps” is now backfiring, as recent Ofsted reports criticized the program’s management and outcomes, leading to negative publicity. These shortcomings have led to low course completion rates and few learners securing jobs.

This mismanagement reflects poorly on the edX brand, potentially eroding its reputation for quality education. The association of the edX name with these problematic bootcamps amplifies the negative impact.

From an outside perspective, it appeared that a significant portion of edX’s efforts went into promoting 2U programs. Unfortunately for both 2U and edX, edX’s declining SEO performance made it increasingly difficult for 2U to monetize its $800 million acquisition effectively.

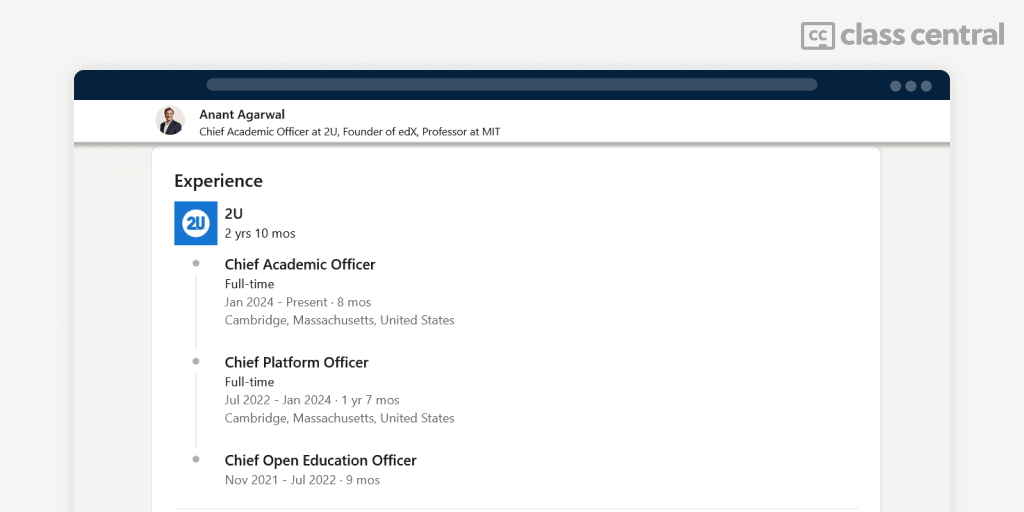

With each round of layoffs and reorganization, edX’s CEO, Anant Agarwal, received a new title at 2U, progressing from Chief Open Education Officer to Chief Platform Officer and finally to Chief Academic Officer. It’s unclear how many of the original edX crew remain. I know that many of them have left or been laid off.

While trying to locate the post about the acquisition on edX’s blog, I realized that the entire edX blog has been removed. However, you can still read the post on the Internet Web Archive.

The very qualities that made edX unique—its non-profit status—were eroded, leaving it a mere shadow of its former self. Its future now rests in the hands of 2U’s creditors.

Axim Collaborative’s Hollow Legacy

Axim Collaborative is the non-profit organization that retained the ~$800 million from the 2U acquisition. It’s the only cash-rich entity in this story, yet three years later, it has little to show for its wealth.

To clarify the somewhat confusing sequence of events:

- The original non-profit edX sold its brand and most assets to 2U.

- The remaining non-profit entity was temporarily renamed “The Center for Reimagining Learning.”

- Last year, this organization was officially named Axim Collaborative and appointed a new CEO.

Organizationally, Axim Collaborative is essentially the continuation of the original edX non-profit, minus the assets sold to 2U. It kept the sale proceeds and the Open edX platform, which wasn’t part of the acquisition.

Notably, some of the same MIT and Harvard leaders who made the decision to sell edX now sit on Axim’s board. These are the same individuals responsible for the disastrous sale.

During the original acquisition announcement, the non-profit was positioned ambitiously:

Backed by these substantial resources, the nonprofit will focus on overcoming persistent inequities in online learning, in part through exploring how to apply artificial intelligence to enable personalized learning that responds and adapts to the style and needs of the individual learner.

However, recent tax returns suggest another reality. According to its 2023 Tax Return (fiscal year ending in June 2023), Axim is sitting on $735 million. In FY 2022, it made $15 million from investment income and had expenses of $9 million.

The promised focus on artificial intelligence and personalized learning seems to have evaporated, especially ironic given the recent AI boom.

Axim appears to have become primarily a grant-giving organization. Besides supporting Open edX, there’s little evidence of using its “substantial resources” for innovation as initially promised.

For perspective, Axim’s current assets exceed the total amount edX spent during its entire non-profit phase.

Instead of being an innovator, Axim Collaborative seems to be a non-entity in the edtech space, its promises of innovation and equity advancement largely unfulfilled.

Tags

Marcus

Many thanks for this great analysis! In conclusion i would say, Coursera controlled now the mooc/online course market, because they had the better strategy. Regarding edX, we have to wait what happens, but i think the creditors who takever 2U sell the most “valuable parts” of the company and liquidate the rest. Whether edX will continue as brand is the question, but it depends mostly what the 2U owners plan.

Axim Collaborative was from the beginning dead. I personally expected more in a shorter time, especially when MIT and Harvard have a 800 million budget for potential investments. We can recognize, MIT and Harvard failed, and are not able to play a key role in this market. I never understand why they have sold edX…

Maybe the chance for FutureLearn to take the second place and being a competitor for Coursera. But to achieve that, a significant improvement (which should not the edX way) is necessarily.

MacCruiskeen

Why did Harvard and MIT sell? Likely because it was expensive to operate and someone was willing to give them a stupid amount of money for it. If that was a mistake, it wasn’t theirs.

Tena Zara Herlihy

As a founding employee, and until 2016, General Counsel of edX, this saddens me. edX had such promise. I hope Axim can use its funds and invest them to provide for edX’s original mission — providing high quality education to anyone with an internet connection for free. edX did live up to its promise for some time.

Growing out of the Harvard and MIT collaboration, more than one hundred of the best universities in the world offered classes for free as part of the edX consortium. Part of this story should be about how successful edX was and how many people benefited from its education.

Jim Q

How is this headline correct? Or, is it just clickbait?

Harvard and MIT sold edX for $800 million, so they came out pretty well, right?

JS

Great analysis. Former Coursera employee here. Interestingly, Coursera’s low-to-high cost “stackability” thesis [0] is based on similarly flawed logic to 2Us free-to-degree / edX-to-2U thesis: that a sufficient % of Learners attracted to low-cost programs can be efficiently upsold into *much* higher-cost, higher-margin programs like online degrees. It’s an attractivee narrative but, like 2Us, it largely doesn’t track to reality.

I don’t think the crux of why these theses haven’t been proven out is terribly complex. I think it’s consumer psychology 101:

1. Consumers who are shopping for A at X price point ($0 – $49/mo) aren’t mentally, financially, or emotionally prepared to buy B at 15X price point ($5k-$20k / yr). And if and when they are interested and prepared to buy B (which a relatively small % are), they’ll restart their shopping experience and weight their experience w/ A lightly. B is too costly of a decision — both in $s and time — to base it upon, in a material way, A.

2. Consumers will bias strongly towards the lowest cost product that helps them confidently achieve their desired outcome. Coursera’s Professional Certs ($0-49/mo), which is an incredibly strong and differentiated product, compete head-to-head w/ Degrees in some cases. And when they do, they’re mostly going to win because they’re lower cost, require less effort, and, occassionally, provide Consumers with more decision confidence than degrees (learn skills from Google+Coursera > learn skills from Univ. of Illinois). It’s not a surprise that Professional Certs are driving the lion’s share of Coursera’s growth while Degrees lag.

To Coursera’s benefit, Degrees is a tertiary business line and they’re not dependent on it. And, to their credit, they haven’t allowed potential cannibalization of their Degrees biz to slow their investment in Professional Certs.

If I had to wildly guess what will happen over the next 5 years:

1. Low-cost, narrow-based “Alternative credential” products will continue to boom as more Consumers look to reskill quickly and cost-effectively and Companies look to fill highly-specific skill gaps. Is there a future where Companies care more about an applicant earning X highly-targeted certificate than Y 4 year degree? Perhaps…

2. High-cost, broad-based online degree programs will continue to struggle. No EdTech player will get to positive unit economics on standalone degrees *unless* Universities start lowering prices and show a willingness to cannibalize their traditional offline offerings. Doubtful. Vested interests and incentives are likely too strong.

3. EdTech players who sell “picks and axes” to Unis will continue to do OK — at least for the next 5 years — as Unis continue to invest in online tech that supplements their traditional offerings.

[0] Slide 13: https://s27.q4cdn.com/928340662/files/doc_financials/2024/q2/COUR_Presentation_Q2-2024.pdf

Jeff Winchell

Good analysis.

Only other point to consider is if the amount of loan foregiveness in the US finally forces US colleges to reduce their absurd prices due to overmarketing the value of bachelors and higher level degrees and the collusion between government and moneyed interests making college loans non-dischargeable leading to 800% increase in student loans following that.

Only when rational decision making by potential students and employers replaces marketing greed and political immorality will the value of different education modes in US become equitably priced.

Dennis

Dhawal Shah, do you recommend learners then to sign up edX courses in future?

What’s your take based on your forecast analysis?

Thanks.

Régis Behmo

As a member of the Open edX technical oversight committee, and a long time core contributor, I’d like to comment on the future of Open edX — the open source project. I’m not an employee of Axim or 2U though, so I can’t say anything about their plans.

As you explained, Axim is the only “cash-rich entity” to have emerged after the edX acquisition. They retained control of the open source Open edX project, and are now in charge of its maintenance and improvement. That is with the support of many open source contributors, of course.

For those who don’t know, Open edX is the piece of software on which runs edX.org, but also MITx and many other open online learning platforms around the world. It’s a big software project that has managed to carve a niche in a complex ecosystem.

Your analysis that Axim is mostly a grant-giving organisation is very far from the reality. Yes, Axim is allocating part of its endowment to grants, though I don’t have much insight into this aspect of their mission. What I do know, is that Axim is also investing a very substantial amount of time and money in the development of the open source project, and that is no trivial feat. You can make your own opinion by checking the project activity on GitHub and the Open edX forum.

To put things simply, the open source project is undergoing an important transition where we have fewer dedicated engineers (because of the layoffs at 2U) but much better project management and focus (because the project roadmap is no longer dictated by edX). There’s also a lot of internal debate of where the project should be headed, strategically speaking (I have my own opinion, which you can find elsewhere). None of this would be possible without Axim and its financial independence.

This transition is long and complicated, and it’s not one we can accelerate just by throwing money at it. Also, I like to think of education as a complex ecosystem that improves in incremental steps. AI and personalised learning might play a role in that process, but they are most certainly not a panacea. It would be meaningless to invest these $735 million in such a narrow scope. Instead, it makes much more sense to to build a stable foundation for the future of open online learning.

In a nutshell: don’t give up on Open edX just yet, the best things are yet to come 🙂

Curt Carpenter

At the dawn of the MOOCs era, I thought they had the potential to change the world — and few of them taken over the early years certainly changed mine. Surely there is some sustainable economic model that will allow this idea to survive. Perhaps more effort should be made in promoting on-line education as a public good that benefits the entire society and merits public investment.

It has been sad to watch the decline. I will check out the Open EdX effort.

Amin

2U owned EdX platform yet bankrupted ?!?

They were not taking EdX courses or what?

Indeed, the carpenter’s door is usually broken